The $3 billion valuation Siam Commercial Bank Pcl is seeking for part or all of its life unit looks too high, yet the promise of improving on Thailand's low insurance penetration levels has attracted at least five bidders, including the pan-Asian giant AIA Group Ltd. and Prudential Plc of the U.K.

Others after a piece of the country's fifth-largest insurer by assets -- and the privilege of selling through the parent bank's 1,000 branches -- include Thai billionaire Charoen Sirivadhanabhakdi in partnership with Singapore’s Great Eastern Holdings Ltd.; Canada's Manulife Financial Corp.; and Hong Kong tycoon Richard Li’s FWD Group, Bloomberg News reports.

The interest in SCB Life Assurance Pcl is understandable. The buyer will get a rarely available asset in Southeast Asia, an area coveted by Japanese Insurers and Western firms grappling with slowing growth at home. The region is notable for limited adoption of insurance, and levels in Thailand are among the lowest, Fitch Ratings said in a report a couple of years ago. An ascendant middle class means prospects for sales growth are strong.

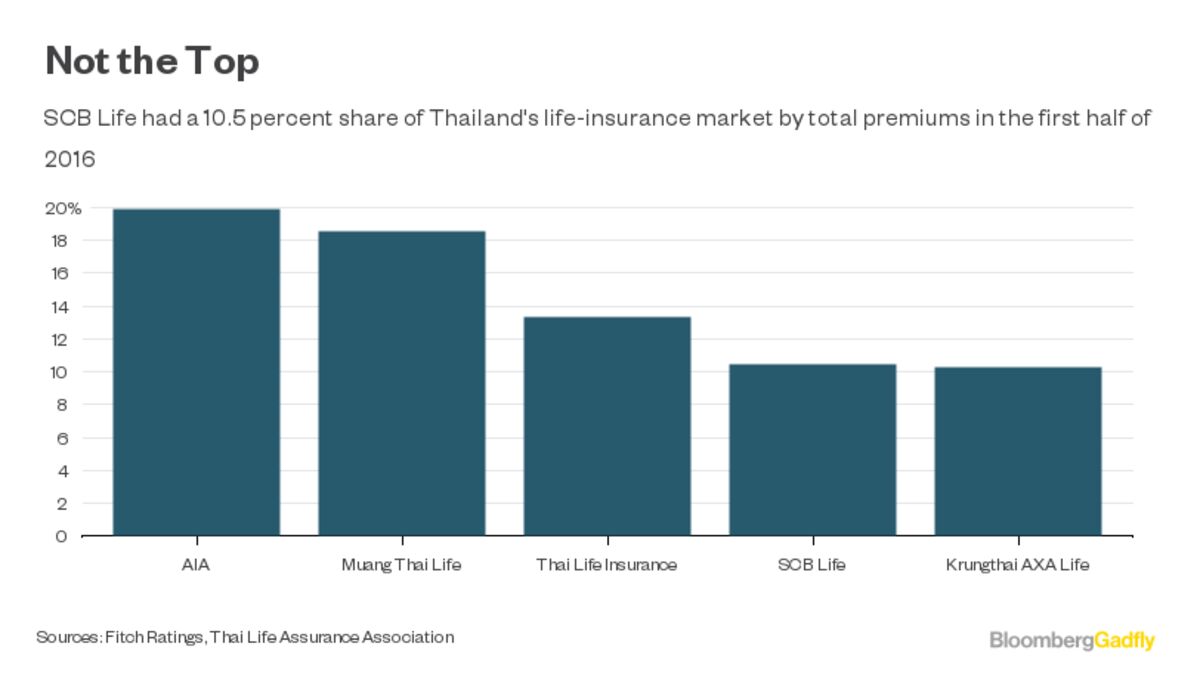

FWD, if successful, would be able to consolidate its position in Thailand after buying ING Groep NV units when the Dutch bank sold out of Asia to repay a government bailout. AIA, already No. 1 in Thailand by total premiums, would gain an added edge there.

Set those advantages against the price, however. A $3 billion valuation is high for an insurer that is only Thailand's fourth-biggest by premiums, with a 10.5 percent market share in the first half of 2016.

That tag is also almost one-third more than the $2.2 billion valuation SCB Life attracted when Siam Commercial Bank bought out the insurer just under two years ago.

Previous deals have been well under the $2 billion mark. Meiji Yasuda Life Insurance Co., for example, bought 15 percent of Thai Life Insurance Pcl for $714 million in 2013, data compiled by Bloomberg show.

The added attraction of SCB is so-called bancassurance. While selling through bank branches is great for revenue growth, however, there's not much evidence that it boosts profits.

Among the biggest bancassurance deals in Asia were AIA's deal with Citigroup Inc., Prudential's with Standard Chartered Plc, and Manulife's sales through DBS Group Holdings Ltd. Such arrangements can cost as much as $1 billion upfront, plus fees paid over time. And banks aren't always the best vendors of insurance, preferring to sell their own products. Insurers generally make higher margins on agency sales than through banks, as consumers prefer to buy more expensive, longer-term policies through an agent tied to the insurer.

SCB has much to offer an insurer seeking a growth market. But the price is probably too steep for a company that isn't the leader in that market.

No comments:

Post a Comment