Sony Financial Group, a major player in the property and casualty (P&C) and life insurance markets, has announced the acquisition of Japanese InsurTech startup JustinCase. The acquisition will enable Sony Financial Group to expand its offerings in the small-amount, short-term insurance market.

While the financial details of the deal have not been disclosed, the move underscores Sony Financial Group’s ambition to enhance its portfolio and meet growing consumer demand for flexible and accessible insurance solutions.

JustInCase - founded in 2016, specialises in providing on-demand insurance products tailored to consumer needs. Its offerings include unique short-term options such as one-day injury coverage and one-night hospital insurance, making it a standout in the InsurTech sector.

The company has raised approximately $11m in funding to date, which has supported its mission to make insurance more adaptable and user-friendly.

Sony Financial Group operates across various insurance domains, including P&C and life insurance.

By integrating JustInCase’s capabilities, the group aims to diversify its services and address changing consumer preferences, particularly in the niche of short-term, small-amount insurance policies.

This acquisition reflects Sony Financial Group’s strategy to adapt to the evolving insurance landscape and position itself as a leader in innovative insurance solutions.

This strategic acquisition also signals Sony Financial Group’s focus on responding to modern consumer needs in Japan and potentially expanding its footprint in global markets.

Friday, November 29, 2024

Indonesia To Counter Medical Inflation

To counter high medical inflation, the Financial Services Authority (OJK) is planning several initiatives for the health insurance market in Indonesia. Due to rising healthcare costs, health insurance claims are already greater than the premiums received, with the loss ratio exceeding 100%. This means that health insurers pay out more money on customers' medical claims than they receive in insurance premiums from policyholders.

OJK’s proposed measures are to:

1: form a medical advisory board that will provide insurers with input on managing services from the medical aspect and in providing input for partner hospitals

2: continue to encourage the strengthening of digital capabilities in the health insurance ecosystem, such as sharing of data with hospitals; increasing the capabilities of medical personnel to analyse data and provide input to hospitals

3: encourage insurers to review existing products that suit customer needs and ensure adequate risk management.

4: encourage insurers to continue to conduct regular public education through digital channels to promote a healthy lifestyle.

Regulation

The OJK said that a circular on improving health insurance processes will be issued next year. This will set out the standards and limits of health insurance benefits that can be claimed.

OJK had collaborated with the Indonesian Ministry of Health to formulate policies to improve the health insurance ecosystem. The moves are being made to implement the Coordination of Benefit (CoB) mechanism that regulates the total health insurance benefits received by an individual who has health insurance policies with more than one insurer.

Under this mechanism, individuals first receive health insurance benefits provided by the BPJS Kesehatan, the social security agency that manages the National Health Insurance scheme. Additional health insurance can be provided as a supplement to BPJS Kesehatan coverage.

The first stage of health insurance benefits remains at BPJS, then to additional health insurance. That is already underway.

Chinese Invests in Indonesia

Indonesia, with its youthful population, burgeoning economy, and rapidly expanding digital landscape, presents an irresistible opportunity for Chinese brands seeking to escape slowing growth and fierce competition at home. Indonesia's allure is multifaceted. Its population of over 270 million, predominantly young adults, fuels a dynamic consumer market. With a median age of 28 to 30, this demographic dividend is further amplified by robust economic growth, consistently exceeding the global average at 5% GDP growth.

Lower labor and rental costs compared to many other Southeast Asian markets add to its cost-effectiveness. Crucially, with over 185.3 million internet users, internet penetration stands at over 66%. With over 185 million internet users at the start of 2024, a digitally savvy consumer base is readily accessible through online channels.

Driven by the faster pace of information, Indonesians are increasingly open to exploring a wider range of brands. This openness has created fertile ground for the influx of Chinese brands. The timing of the ripening of Indonesia as a market was ‘just right’ for many Chinese companies looking to expand outwards due to ferocious competition and slowing economic growth at home, and they started making inroads in the archipelago.

Today, Chinese companies are everywhere. They have a presence in almost every growing sector—from nickel ore and steel to clothing, smartphones and electric vehicles. Four of every five EVs sold in Indonesia are from Chinese brands such as Wuling, BYD, Chery, and Neta, according to data from the Indonesian Automotive Industry Association (Gaikindo).

Meanwhile, Indonesia happens to be one of TikTok’s most attractive markets, and it entered into a very expensive marriage with Tokopedia to circumvent the government ban in 2023. Retail is another sector China is aggressively wooing as its companies look outward due to ferocious competition and slowing economic growth at home. Indonesia’s retail market was valued at $46.34 billion in 2022 and is projected to reach $71.89 billion by 2031.

There’s been a noticeable surge of inquiries from China for almost every premium mall landlord in Jakarta in the past year. More than half of the inquiries come from the F&B category, such as Cotti Coffee, Naixue, Jiguang, Mixue, Wallace, and Yao Yao. On the retail side, there are brands such as Huawei, Oppo, Pop Mart, M&G Life, Anta, Vivaia, and HLA.

The proliferation of several Chinese lifestyle brands in the retail space in Indonesia is an exciting development. A wider choice creates more interest and inevitably generates buzz in the category. Retailers also actively exploring several such brand partnerships and will soon be bringing them to the Indonesian marketplace. From a real estate perspective, we believe there is enough room for everyone to co-exist. Plus, choice brings more footfall to the malls, hopefully benefiting all retailers.

Miniso - The success story of Miniso One Chinese brand that has managed to carve a niche for itself in Indonesia and can be a case study for brands looking to enter the country is the variety shop Miniso. For Miniso, Indonesia has consistently ranked in the top five of the 111 countries in which the retailer is present in terms of gross merchandise volume (GMV).

The launch of their largest global store in Indonesia in August 2024, after opening close to 300 stores in seven years, only cements this market’s importance. The world's largest Miniso store opened in Jakarta in August. First-day sales of 1.18 million RMB set a new record.

As part of its ‘super store strategy’, Miniso opened its flagship store, the largest in the world, in Jakarta’s Central Park Mall. Since entering Indonesia, Miniso has aggressively used IP as a differentiator. In Southeast Asia, particularly in Indonesia, consumers tend to favour Japanese and Korean IPs.

For instance, One Piece was quickly sold out upon release, and Zanmang Loopy, a Korean animation, has the highest viewership in Indonesia among overseas markets. Miniso has collaborated with the local supply chain in Indonesia, producing many locally sourced items like skincare, cosmetics, perfumes, and fragrances.

In eight years, Miniso has cracked a supply chain hybrid combination of headquarters and local suppliers, offering over 10,000 SKUs. The retailer is now focusing on opening larger and better stores in Indonesia, upgrading store locations, expanding the product range, and investing in local staff training.

Chinese brands have disrupted the Indonesian retail space. He says that multi-branded retail concepts in Indonesia—both local and foreign—are facing stiff competition from the burgeoning of Chinese brands such as Miniso, which relies heavily on its IP collectables category.

Thursday, November 28, 2024

Health Insurance Premium Hike - Again

Medical insurance premiums are expected to rise between 40 and 70 per cent next year (2025), following notices sent by insurance providers to policyholders citing the rising cost of medical care in private hospitals as the primary reason.

Many users have opted to cancel their medical insurance policies as they can no longer afford the increasing premiums that need to be paid every month. As an alternative, they choose to use insurance provided by their employers or opt to use government hospital services.

The majority of medical insurance cardholders have expressed dissatisfaction and questioned these increases, which they believe are not only burdensome but also unreasonable. A Customer had already received a letter from his insurance company stating that the premium increase would take effect in February next year (2025).

This year (2024), the company has already raised the premium by over RM40. Next year, it will double. I used to pay RM188.47 a month, and now I have to pay RM237.34, even though there was a previous increase last year, from RM157.69 to RM188.47.

Many users have opted to cancel their medical insurance policies as they can no longer afford the increasing premiums that need to be paid every month. As an alternative, they choose to use insurance provided by their employers or opt to use government hospital services.

The majority of medical insurance cardholders have expressed dissatisfaction and questioned these increases, which they believe are not only burdensome but also unreasonable. A Customer had already received a letter from his insurance company stating that the premium increase would take effect in February next year (2025).

This year (2024), the company has already raised the premium by over RM40. Next year, it will double. I used to pay RM188.47 a month, and now I have to pay RM237.34, even though there was a previous increase last year, from RM157.69 to RM188.47.

Another Customer, said his insurance policy had also increased by RM133, from RM244 to RM377 per month. He has even considered the possibility of stopping the payments in the future.

Meanwhile, Consumers Association of Subang and Shah Alam (CASSA) president Datuk Seri Dr Jacob George said it was not reasonable to increase insurance premiums given the current cost of living.

Bayan Baru member of parliament Sim Tze Tzin said that his office would be meeting not only with insurance companies but also with private hospitals to gather more information.

Meanwhile, Consumers Association of Subang and Shah Alam (CASSA) president Datuk Seri Dr Jacob George said it was not reasonable to increase insurance premiums given the current cost of living.

Bayan Baru member of parliament Sim Tze Tzin said that his office would be meeting not only with insurance companies but also with private hospitals to gather more information.

Perkeso - 24 Hours Coverage

By the middle of next year (2025), nearly nine million Malaysian workers, could enjoy 24-hour Social Security Organisation (Perkeso) coverage. Perkeso's Employment Injury Scheme currently protects employees in the course of their work, but efforts are underway to expand the coverage to all hours.

The government wants to amend the Employees' Social Security Act to provide 24-hour coverage. Right now, many employees come to Perkeso wanting to claim benefits after getting involved in accidents outside working hours. perkeso can't help them because the law doesn't allow it.

Small & Medium Enterprises - More than 95 per cent of companies in the country are micro, small and medium enterprises (MSMEs), and they may not be able to afford insurance benefits for their workers. Once the law was amended, Perkeso would provide 24-hour coverage for all accidents, regardless if they were work-related or not.

Perkeso scheme offers protection (provided lump-sump payments) and also designed for jncome replacement. Example - a member loses a leg at work, Perkeso will compensate the member for 90 per cent of your average last drawn salary for the rest of your life.

Now you only have that coverage if you lose your leg in the course of your work. Once we have 24-hour protection you will always be covered, even if you are injured at home."

The same applies to death benefits, where Perkeso pays a contributor's dependants 90 per cent of the average salary for the rest of their lives and their children until they reach the age of 21.

Round-the-clock protection could be important for those in the private sector as many workers cannot afford to rely on their retirement savings in the event of an injury or disability outside of work.

In November last year, the Finance Ministry revealed that 6.3 million Employees' Provident Fund members under 55 had less than RM10,000 in their accounts.

The 24-hour coverage would require workers to make additional monthly contributions at a quantum to be finalized by the government. The 24-hour scheme would also cover Malaysians injured on overseas work trips.

The government wants to amend the Employees' Social Security Act to provide 24-hour coverage. Right now, many employees come to Perkeso wanting to claim benefits after getting involved in accidents outside working hours. perkeso can't help them because the law doesn't allow it.

Small & Medium Enterprises - More than 95 per cent of companies in the country are micro, small and medium enterprises (MSMEs), and they may not be able to afford insurance benefits for their workers. Once the law was amended, Perkeso would provide 24-hour coverage for all accidents, regardless if they were work-related or not.

Perkeso scheme offers protection (provided lump-sump payments) and also designed for jncome replacement. Example - a member loses a leg at work, Perkeso will compensate the member for 90 per cent of your average last drawn salary for the rest of your life.

Now you only have that coverage if you lose your leg in the course of your work. Once we have 24-hour protection you will always be covered, even if you are injured at home."

The same applies to death benefits, where Perkeso pays a contributor's dependants 90 per cent of the average salary for the rest of their lives and their children until they reach the age of 21.

Round-the-clock protection could be important for those in the private sector as many workers cannot afford to rely on their retirement savings in the event of an injury or disability outside of work.

In November last year, the Finance Ministry revealed that 6.3 million Employees' Provident Fund members under 55 had less than RM10,000 in their accounts.

The 24-hour coverage would require workers to make additional monthly contributions at a quantum to be finalized by the government. The 24-hour scheme would also cover Malaysians injured on overseas work trips.

Monday, November 25, 2024

Thailand - Thonburi Healthcare Group

Boon Vanasin, the founder of Thonburi Healthcare Group (THG), is currently at large in China while his wife and daughter have surrendered to the police in Thailand. Faced with charges of public fraud, 79 year old Jaruwan Vanasin, and her daughter, 51 year old Nalin, turned themselves in to the police and have denied all allegations against them.

The two women chose not to speak to the media when they surrendered. Their lawyer, however, stated that they are denying any involvement in the fraudulent activities attributed to them. They claim their signatures were forged, and they did not sign any cheques related to the alleged schemes.

The Metropolitan Police Bureau secured court approval to arrest 86 year old Boon, along with his wife and daughter. Arrest warrants were also issued for six other suspects involved in the case, all of whom were apprehended yesterday, November 23.

The investigation accuses the suspects of misleading investors in medical ventures promoted by Boon. Additionally, Boon is alleged to have forged his former daughter-in-law’s signature to secure a loan, resulting in damages estimated at 7.5 billion baht. The Criminal Court issued an arrest warrant for Boon on charges of public fraud, fraudulent borrowing, money laundering, and issuing bad cheques.

Similar charges have been levelled against the other suspects. Between December last year and October this year, 527 complaints were filed against Boon at the Huai Khwang police station by victims who were unable to cash the cheques he issued.

Boon leveraged his status as a prominent hospital executive to promote five medical-related projects, including a cancer centre, a wellness centre in Thailand, hospitals in Laos and Vietnam, and a medical intelligence project, attracting substantial investments.

The total investment for these projects exceeded 16 billion baht, with investors being promised 700 million baht in profits for last year and 1 billion baht for this year. Although initial payments were made, subsequent payments were missed, causing turmoil for investors attempting to cash their cheques, according to a source familiar with the investigation.

Police Major General Noppasin Poonsawat, the deputy commissioner of the Metropolitan Police Bureau, revealed that Boon fled Thailand on September 29, travelling from Bangkok to Hong Kong before proceeding to China.

Boon previously clashed with stock market regulators in 2022 for disseminating false information that inflated THG’s share price. In the preceding year, he had also claimed that THG had acquired 20 million doses of Covid-19 vaccines from Pfizer for Thailand, a delivery that never transpired.

Yesterday, November 23, police arrested two women linked to Boon’s network at a law firm in Bang Bua Thong district of Nonthaburi. These women, identified as 38 year old Siriwimol and 53 year old Jidapha, face fraud and fraudulent borrowing charges. A Mercedes-Benz was seized from them during the arrest.

The two women chose not to speak to the media when they surrendered. Their lawyer, however, stated that they are denying any involvement in the fraudulent activities attributed to them. They claim their signatures were forged, and they did not sign any cheques related to the alleged schemes.

The Metropolitan Police Bureau secured court approval to arrest 86 year old Boon, along with his wife and daughter. Arrest warrants were also issued for six other suspects involved in the case, all of whom were apprehended yesterday, November 23.

The investigation accuses the suspects of misleading investors in medical ventures promoted by Boon. Additionally, Boon is alleged to have forged his former daughter-in-law’s signature to secure a loan, resulting in damages estimated at 7.5 billion baht. The Criminal Court issued an arrest warrant for Boon on charges of public fraud, fraudulent borrowing, money laundering, and issuing bad cheques.

Similar charges have been levelled against the other suspects. Between December last year and October this year, 527 complaints were filed against Boon at the Huai Khwang police station by victims who were unable to cash the cheques he issued.

Boon leveraged his status as a prominent hospital executive to promote five medical-related projects, including a cancer centre, a wellness centre in Thailand, hospitals in Laos and Vietnam, and a medical intelligence project, attracting substantial investments.

The total investment for these projects exceeded 16 billion baht, with investors being promised 700 million baht in profits for last year and 1 billion baht for this year. Although initial payments were made, subsequent payments were missed, causing turmoil for investors attempting to cash their cheques, according to a source familiar with the investigation.

Police Major General Noppasin Poonsawat, the deputy commissioner of the Metropolitan Police Bureau, revealed that Boon fled Thailand on September 29, travelling from Bangkok to Hong Kong before proceeding to China.

Boon previously clashed with stock market regulators in 2022 for disseminating false information that inflated THG’s share price. In the preceding year, he had also claimed that THG had acquired 20 million doses of Covid-19 vaccines from Pfizer for Thailand, a delivery that never transpired.

Yesterday, November 23, police arrested two women linked to Boon’s network at a law firm in Bang Bua Thong district of Nonthaburi. These women, identified as 38 year old Siriwimol and 53 year old Jidapha, face fraud and fraudulent borrowing charges. A Mercedes-Benz was seized from them during the arrest.

Indonesia Universal Health Coverage Financial Distress

After experiencing slow times during the pandemic, which resulted in a revenue surplus, the Healthcare and Social Security Agency (BPJS Kesehatan) slipped back into financial distress again last year.

As people began to flock to hospitals and healthcare centers again, National Health Insurance (JKN) claims started to pile up for the non-profit agency, resulting in a deficit of Rp 7.4 trillion (US$473.8 million), or 4.8 percent of the total premium payments by members last year. The deficit is expected to rise to a record high this year as the number of people covered by the insurance amounts to more than 267 million, more than 95 percent of the population.

With the large number of people to cover, the insurer faces greater potential for higher claims and more challenges in regard to premium collection. Indonesia rolled out the JKN insurance under BPJS Kesehatan in 2014 in an attempt to provide universal health coverage for its people.

The large population covered under the scheme made the JKN the largest single-payer health insurance system in the world in 2021, according to medical journal Lancet. The national health scheme is funded by the government at national and regional levels to cover the poor, low-income families and retired government employees, which altogether account for about 54 percent of JKN members.

Social contributions for workers, paid jointly by employees and employers, also play a significant role as they account for 20 percent of the health scheme. Members who work in the informal sector or are self-employed register themselves for the insurance independently, and account for the remaining 26 percent of the JKN coverage.

Prior to the pandemic, BPJS Kesehatan became embroiled in a constant deficit because of mismanagement and an insufficiency of healthcare providers. The lack of implementation of standards of medicines and health services led to poor judgment by hospitals and doctors in allocating the services, leading to soaring claims and medicine scarcity for critical diseases.

95.7% Coverage For Indonesia National Health Scheme

The National Health Insurance (JKN) coverage has reached 267 million people, or equivalent to 95.77 percent of the nation’s population, by 2023-end, according to the Health Ministry’s Director General of Health Services.

The number almost reached the 98 percent coverage target as mandated by the 2024 RPJMN (National Middle-term Development Plan) according to state health insurer BPJS Kesehatan.

Out of the 267 million insurance participants, 214 million can be considered as being “active participants” who pay their insurance fees. Meanwhile, another 54 million participants are considered “non-active". “Some 99 percent of the 54 million non-active participants, equal to 53.8 million, are PBPU (non-wage earners) participants.

Insurance participants are considered non-wage earners if they work in the non-formal sector or micro, small, and medium enterprises.

By February 2024, the number of JKN participants reached 268 million, an increase of one million from the 2023-end figure. The latest number has shown significant progress from 2014 when the insurer recorded only 133 million insurance participants at that time.

The number almost reached the 98 percent coverage target as mandated by the 2024 RPJMN (National Middle-term Development Plan) according to state health insurer BPJS Kesehatan.

Out of the 267 million insurance participants, 214 million can be considered as being “active participants” who pay their insurance fees. Meanwhile, another 54 million participants are considered “non-active". “Some 99 percent of the 54 million non-active participants, equal to 53.8 million, are PBPU (non-wage earners) participants.

Insurance participants are considered non-wage earners if they work in the non-formal sector or micro, small, and medium enterprises.

By February 2024, the number of JKN participants reached 268 million, an increase of one million from the 2023-end figure. The latest number has shown significant progress from 2014 when the insurer recorded only 133 million insurance participants at that time.

Accelerating Medical Claims Indonesia

The life insurance industry in Indonesia paid out $4.89b (IRD77.67t) in claims to over 9.82 million beneficiaries during the first half of 2024 (H1 2024). Whilst the total claims decreased overall, health-related claims rose significantly during this period.

Surrender claims and death claims fell by 13.5% year-on-year (YoY) and 5.1% YoY, respectively, driving the overall decline. However, health claims surged by 26% to $0.74b (IDR11.83t) in H1 2024.

Individual health claims increased by 29.3% YoY to $0.48b (IDR7.62t), whilst group health claims grew by 20.3% YoY to $0.27b (IDR4.21t). The ratio of health insurance claims to premium income reached 105.7% YoY, indicating that payouts exceeded premiums collected, presenting financial challenges for insurers.

The rise in health claims is attributed to growing medical inflation and emphasized the industry's commitment to providing quality healthcare services. Ongoing coordination with regulators, the Ministry of Health, and healthcare providers to address these challenges and ensure sustainability in managing health insurance claims.

In terms of investment, the life insurance industry's total portfolio reached $33.95b (IDR538.80t) as of June 2024.

Surrender claims and death claims fell by 13.5% year-on-year (YoY) and 5.1% YoY, respectively, driving the overall decline. However, health claims surged by 26% to $0.74b (IDR11.83t) in H1 2024.

Individual health claims increased by 29.3% YoY to $0.48b (IDR7.62t), whilst group health claims grew by 20.3% YoY to $0.27b (IDR4.21t). The ratio of health insurance claims to premium income reached 105.7% YoY, indicating that payouts exceeded premiums collected, presenting financial challenges for insurers.

The rise in health claims is attributed to growing medical inflation and emphasized the industry's commitment to providing quality healthcare services. Ongoing coordination with regulators, the Ministry of Health, and healthcare providers to address these challenges and ensure sustainability in managing health insurance claims.

In terms of investment, the life insurance industry's total portfolio reached $33.95b (IDR538.80t) as of June 2024.

Staging Traffic Accident For Claim

Central China’s Henan police recently cracked a case in which three people were suspected of intentionally staging traffic accidents to defraud insurance payouts. While committing the crime, one suspect was accidentally killed.

A suspect surnamed Hu bought a second-hand SUV and devised a plan to scam insurance money. Hu, supposed to take the role of a passer-by in the hoax, recruited two others to stage a single-vehicle traffic accident. An accomplice surnamed You acted as the driver, while another Hu served as the informant.

In their sham story, You drove the SUV and crashed it into a poplar tree about 50 centimeters in diameter at a downhill corner. Unexpectedly, however, You, the driver, was killed instantly due to a driving error.

During the investigation, police uncovered several anomalies. For example, at the scene of the accident, the SUV’s airbags were not opened, and there were no signs of braking on the road.

Further investigation revealed that Hu, posing as a passer-by, owned a garage and engaged in second-hand car trading, with the insurance payouts directed to one of his accounts. They intentionally staged 11 automobile accidents since 2019, defrauding insurance companies of over 900,000 yuan ($120,000).

A suspect surnamed Hu bought a second-hand SUV and devised a plan to scam insurance money. Hu, supposed to take the role of a passer-by in the hoax, recruited two others to stage a single-vehicle traffic accident. An accomplice surnamed You acted as the driver, while another Hu served as the informant.

In their sham story, You drove the SUV and crashed it into a poplar tree about 50 centimeters in diameter at a downhill corner. Unexpectedly, however, You, the driver, was killed instantly due to a driving error.

During the investigation, police uncovered several anomalies. For example, at the scene of the accident, the SUV’s airbags were not opened, and there were no signs of braking on the road.

Further investigation revealed that Hu, posing as a passer-by, owned a garage and engaged in second-hand car trading, with the insurance payouts directed to one of his accounts. They intentionally staged 11 automobile accidents since 2019, defrauding insurance companies of over 900,000 yuan ($120,000).

Hong Kong Agents Defraud Insurers

A former branch manager of an insurer and 12 ex-insurance agents pleaded guilty on Saturday to conspiring to defraud two insurance companies of HK$52 million (US$6.68 million) by making false policy applications.

Lo Yin-wa, a former branch manager of FWD Life Insurance, was named as a mastermind behind the fraud. She pleaded guilty to 18 charges of conspiracy to launder criminal proceeds and two charges involving conspiracy to defraud. Twelve others, aged between 24 and 61, pleaded guilty to conspiracy to defraud and conspiracy to launder criminal proceeds, including seven insurance agents on Lo’s team.

The other defendants are former unit manager at insurer Sun Life Hong Kong Kwok Yun-fong and four agents under her.

The case arose from a complaint made to the anti-corruption watchdog. The agency launched an investigation and said it found Lo had recruited defendants in the case, as well as other people, to join Sun Life or FWD between February 2016 and November 2020.

Lo had asked her agents to hand most of the commissions and other payments received from the two insurers to her. Defendants then laundered about HK$47 million in criminal proceeds through 23 bank accounts controlled by Lo.

Lo and her agents at FWD had falsely stated the agents were handling 272 insurance policy applications. Lo and Kwok, alongside his agents, made false claims involving 206 insurance applications to Sun Life Hong Kong.

Both insurers were unaware of the alleged fraud, approving all applications and disbursing more than HK$22 million in commissions, incentives, bonuses and allowances to Lo’s team, as well as over HK$29 million to Kwok’s team.

The insurance policies were mostly high commission rate products, most of which expired after subsequent premium payments were missed.

Lo Yin-wa, a former branch manager of FWD Life Insurance, was named as a mastermind behind the fraud. She pleaded guilty to 18 charges of conspiracy to launder criminal proceeds and two charges involving conspiracy to defraud. Twelve others, aged between 24 and 61, pleaded guilty to conspiracy to defraud and conspiracy to launder criminal proceeds, including seven insurance agents on Lo’s team.

The other defendants are former unit manager at insurer Sun Life Hong Kong Kwok Yun-fong and four agents under her.

The case arose from a complaint made to the anti-corruption watchdog. The agency launched an investigation and said it found Lo had recruited defendants in the case, as well as other people, to join Sun Life or FWD between February 2016 and November 2020.

Lo had asked her agents to hand most of the commissions and other payments received from the two insurers to her. Defendants then laundered about HK$47 million in criminal proceeds through 23 bank accounts controlled by Lo.

Lo and her agents at FWD had falsely stated the agents were handling 272 insurance policy applications. Lo and Kwok, alongside his agents, made false claims involving 206 insurance applications to Sun Life Hong Kong.

Both insurers were unaware of the alleged fraud, approving all applications and disbursing more than HK$22 million in commissions, incentives, bonuses and allowances to Lo’s team, as well as over HK$29 million to Kwok’s team.

The insurance policies were mostly high commission rate products, most of which expired after subsequent premium payments were missed.

Tuesday, November 19, 2024

Symptoms Of Toxic Leadership

Recognizing that you might be a toxic leader is the first step toward change. Here are some signs to watch out for:

High Employee Turnover - If your team has a high turnover rate, it might be an indication of toxic leadership. Employees generally leave when they feel undervalued or mistreated. As of 2022, 70% of all U.S. employee turnover is voluntary.

High Employee Turnover - If your team has a high turnover rate, it might be an indication of toxic leadership. Employees generally leave when they feel undervalued or mistreated. As of 2022, 70% of all U.S. employee turnover is voluntary.

Low Team Morale - A toxic leader often fosters an environment where employees feel constantly stressed and unhappy.

Poor Communication - These types of leaders often fail to communicate effectively. They may ignore suggestions, provide unclear instructions, or not communicate at all, leading to confusion and inefficiency.

Constant Blame Shifting - Toxic leaders rarely take responsibility for their actions, often deflecting blame onto their team members, which erodes trust and accountability.

Inconsistent Expectations - Unpredictable standards or frequently changing goals can create confusion and frustration within the team, leading to decreased performance and commitment.

Lack of Recognition - If the accomplishments and contributions of team members go unacknowledged, it can foster feelings of being unappreciated among employees, driving them to disengage.

Isolation of Employees - If team members feel excluded from important discussions or decision-making processes, it can lead to a culture of distrust and competition instead of collaboration.

Chiropractor Scammed Singapore Insurer

A chiropractor was taken to court on Tuesday (Jan 22) after he allegedly worked with two insurance agents to cheat Manulife Singapore of more than $14,000 by submitting bogus personal accident claims by 12 people who were covered by the insurer.

Shareholder of Chiropractic Focus Group Charles Loo Boon Ann, 29, is accused of committing the offences with Priscilla Tien Ling, 27, and Mike Chew Jun Yong, 36. Loo was charged with 17 counts of cheating while Tien faces 12 charges for similar offences. Chew was handed nine cheating charges.

The trio allegedly committed their offences between June 2017 and April last year and Manulife Singapore is said to have been duped into delivering the monies to the 12 insurance policy holders.

They allegedly received between $200 and $1,200 each. Tien's cases allegedly involved nine policy holders who received more than $8,000 in all. Five policy holders linked to Chew are said to have received about $7,000 in total.

In a statement on Monday, the police said the trio allegedly cheated the insurance firm through false personal accident claims for treatments received at Loo's clinics in Tampines and Tanjong Pagar. For each count of cheating, offenders can be jailed for up to 10 years and fined.

Shareholder of Chiropractic Focus Group Charles Loo Boon Ann, 29, is accused of committing the offences with Priscilla Tien Ling, 27, and Mike Chew Jun Yong, 36. Loo was charged with 17 counts of cheating while Tien faces 12 charges for similar offences. Chew was handed nine cheating charges.

The trio allegedly committed their offences between June 2017 and April last year and Manulife Singapore is said to have been duped into delivering the monies to the 12 insurance policy holders.

They allegedly received between $200 and $1,200 each. Tien's cases allegedly involved nine policy holders who received more than $8,000 in all. Five policy holders linked to Chew are said to have received about $7,000 in total.

In a statement on Monday, the police said the trio allegedly cheated the insurance firm through false personal accident claims for treatments received at Loo's clinics in Tampines and Tanjong Pagar. For each count of cheating, offenders can be jailed for up to 10 years and fined.

India Mulls Allowing 100% FDI For Insurance Company

The Indian government plans to introduce a significant overhaul of the insurance sector by allowing 100% foreign direct investment (FDI) in insurance companies. This proposal, part of the Insurance Amendment Bill, is expected to be presented during Parliament’s winter session. If implemented, the move could allow foreign insurers to operate independently in the Indian market.

The bill also aims to relax restrictions on insurance agents, permitting them to sell policies from multiple insurers rather than being tied to a single company.

India currently caps FDI in insurance companies at 74% while intermediaries face fewer restrictions. The market includes 24 life insurers, 26 general insurers, six standalone health insurers, and one reinsurer – General Insurance Corporation.

Raising The FDI Limit - to 100% aims to attract international insurers with the financial resources required to grow in a capital-intensive industry. The entry of such players is expected to complement existing domestic firms like SBI, ICICI, HDFC, and prominent conglomerates such as the Tata and Birla groups.

The proposed changes may also prompt foreign companies to reconsider their market strategies. For instance, Allianz, reportedly exploring an end to its partnership with Bajaj Finserv, could potentially enter the Indian market as an independent operator under the new framework.

Relaxing Restrictions On Agents - is another key element of the proposed reforms. Currently, agents often register family members to represent additional insurers, a practice that the new rules would legitimize. By allowing agents to sell products from multiple companies, the government hopes to streamline the market and enhance transparency.

India’s insurance penetration stands at approximately 4%, prompting calls for increased investment and structural reforms to grow the market.

To address this, IRDAI is exploring additional measures, including the introduction of composite licenses. This change would allow insurers to offer life and non-life policies through a single entity, potentially benefiting companies like Life Insurance Corporation of India, which is reportedly seeking to acquire a health insurer to diversify its offerings.

Further proposals include reducing solvency requirements to free up capital, which would enable insurers to expand their underwriting capacity.

The bill also aims to relax restrictions on insurance agents, permitting them to sell policies from multiple insurers rather than being tied to a single company.

India currently caps FDI in insurance companies at 74% while intermediaries face fewer restrictions. The market includes 24 life insurers, 26 general insurers, six standalone health insurers, and one reinsurer – General Insurance Corporation.

Raising The FDI Limit - to 100% aims to attract international insurers with the financial resources required to grow in a capital-intensive industry. The entry of such players is expected to complement existing domestic firms like SBI, ICICI, HDFC, and prominent conglomerates such as the Tata and Birla groups.

The proposed changes may also prompt foreign companies to reconsider their market strategies. For instance, Allianz, reportedly exploring an end to its partnership with Bajaj Finserv, could potentially enter the Indian market as an independent operator under the new framework.

Relaxing Restrictions On Agents - is another key element of the proposed reforms. Currently, agents often register family members to represent additional insurers, a practice that the new rules would legitimize. By allowing agents to sell products from multiple companies, the government hopes to streamline the market and enhance transparency.

India’s insurance penetration stands at approximately 4%, prompting calls for increased investment and structural reforms to grow the market.

To address this, IRDAI is exploring additional measures, including the introduction of composite licenses. This change would allow insurers to offer life and non-life policies through a single entity, potentially benefiting companies like Life Insurance Corporation of India, which is reportedly seeking to acquire a health insurer to diversify its offerings.

Further proposals include reducing solvency requirements to free up capital, which would enable insurers to expand their underwriting capacity.

Manulife Surpass Earnings Target

Manulife, Canada's biggest insurance company, is on track to surpass its earnings target in Asia, as a result of the launch of several innovative products that have been lapped up by wealthy customers and mainland visitors buying policies in Hong Kong.

The Toronto-based insurer's third-quarter results released last week showed a 17 per cent increase in core earnings - profits generated from its primary business activities - in Asia. The region was also the largest profit contributor, accounting for 44 per cent of the group's total earnings. This was up from 37 per cent last year and approaching its target of 50 per cent from Asia by 2027.

Hong Kong, its Asian headquarters, has been a driving force behind the stellar gains. Annualized premiums collected from insurance sales rose 173 per cent year on year to US$570 million in the third quarter, as a rising number of mainland visitors continue buying insurance cover in the city. Mainland visitors' purchases represented 30 per cent of the total, with the rest coming from locals.

In the first half of the year, the city received 21 million tourists, an increase of 64 per cent from a year ago, according to data published by the Hong Kong Tourism Board. Two-thirds of them were from the mainland. Manulife has a wide range of products that can fulfil the needs of mainland Chinese visitors in terms of life protection and medical and legacy planning.

The company has made policy sales through agents a priority, investing in the distribution channel and introducing a program called Manulife Pro for top-tier agents in Hong Kong to improve their productivity.

Other Key Markets In Asia-Pacific - China, Singapore, Japan, the Philippines, Indonesia and Malaysia - also reported strong sales following the launch of innovative products, customer apps and investment in call centre technology.

Manulife rolled out the new call centre technology in Japan in the third quarter to enable voice-to-text and other artificial intelligence solutions to reply to customers' inquiries. It also introduced new apps in Vietnam and Indonesia in the second quarter.

In May, the firm introduced a new product called Genesis, which provides flexible withdrawal options and estate-planning features. It also created an integrated high-net-worth platform in Hong Kong, Singapore and Bermuda to tap wealthy customers.

High-net-worth customers need insurance protection, medical coverage, wealth management, and estate planning. There are a lot of wealthy customers in Hong Kong, the Greater Bay Area and other parts of Asia, which are future growth engines for Manulife.

Manulife and others such as HSBC and UBS are all eyeing a bigger slice of the growing wealth management business in Hong Kong.

Assets under management in Hong Kong rose 2 per cent year on year to more than HK$31 trillion (US$4 trillion) at the end of 2023, according to data from the Securities and Futures Commission. Net fund inflows reached HK$390 billion, a year-on-year increase of over 3.4 times, thanks to the development of the family office business.

The Toronto-based insurer's third-quarter results released last week showed a 17 per cent increase in core earnings - profits generated from its primary business activities - in Asia. The region was also the largest profit contributor, accounting for 44 per cent of the group's total earnings. This was up from 37 per cent last year and approaching its target of 50 per cent from Asia by 2027.

Hong Kong, its Asian headquarters, has been a driving force behind the stellar gains. Annualized premiums collected from insurance sales rose 173 per cent year on year to US$570 million in the third quarter, as a rising number of mainland visitors continue buying insurance cover in the city. Mainland visitors' purchases represented 30 per cent of the total, with the rest coming from locals.

In the first half of the year, the city received 21 million tourists, an increase of 64 per cent from a year ago, according to data published by the Hong Kong Tourism Board. Two-thirds of them were from the mainland. Manulife has a wide range of products that can fulfil the needs of mainland Chinese visitors in terms of life protection and medical and legacy planning.

The company has made policy sales through agents a priority, investing in the distribution channel and introducing a program called Manulife Pro for top-tier agents in Hong Kong to improve their productivity.

Other Key Markets In Asia-Pacific - China, Singapore, Japan, the Philippines, Indonesia and Malaysia - also reported strong sales following the launch of innovative products, customer apps and investment in call centre technology.

Manulife rolled out the new call centre technology in Japan in the third quarter to enable voice-to-text and other artificial intelligence solutions to reply to customers' inquiries. It also introduced new apps in Vietnam and Indonesia in the second quarter.

In May, the firm introduced a new product called Genesis, which provides flexible withdrawal options and estate-planning features. It also created an integrated high-net-worth platform in Hong Kong, Singapore and Bermuda to tap wealthy customers.

High-net-worth customers need insurance protection, medical coverage, wealth management, and estate planning. There are a lot of wealthy customers in Hong Kong, the Greater Bay Area and other parts of Asia, which are future growth engines for Manulife.

Manulife and others such as HSBC and UBS are all eyeing a bigger slice of the growing wealth management business in Hong Kong.

Assets under management in Hong Kong rose 2 per cent year on year to more than HK$31 trillion (US$4 trillion) at the end of 2023, according to data from the Securities and Futures Commission. Net fund inflows reached HK$390 billion, a year-on-year increase of over 3.4 times, thanks to the development of the family office business.

Monday, November 18, 2024

61% Malaysian Have Difficulty To Raise RM1,000 For Emergency

The financial knowledge of Malaysians has significantly improved since 2016 and is approaching the level of developed countries, however, there are still three challenges hindering further progress towards becoming a financially literate society.

Bank Negara Malaysia (BNM) said this improvement in the knowledge level is reflected in the financial survey results of the Organisation for Economic Co-operation and Development (OECD) last year. Based on the OECD study for 2023, the financial literacy level of Malaysians has risen significantly, surpassing the global average and approaching the level of other developed countries.

Financial Capability and Inclusion Survey conducted by BNM recently identified three key financial challenges still faced by Malaysians: poor financial management, saving habits, and digital financial literacy.

61% Difficult To Come Up With RM1,000 For Emergency - remains a concerning issue, with the survey revealing that one in four Malaysians feels their debt is burdensome, while wide access to financial services such as having a deposit account does not translate into meaningful saving habits and usage. According to the same survey, 61 per cent of Malaysians would have difficulty to come up with RM1,000 in case of an emergency.

Low level of digital financial literacy was highlighted by the survey, with 15 per cent of the population, mostly teenagers, sharing their banking passwords. This practice exposes them to the increasing rate of online scams and being used as money mules.

Bank Negara Malaysia (BNM) said this improvement in the knowledge level is reflected in the financial survey results of the Organisation for Economic Co-operation and Development (OECD) last year. Based on the OECD study for 2023, the financial literacy level of Malaysians has risen significantly, surpassing the global average and approaching the level of other developed countries.

Financial Capability and Inclusion Survey conducted by BNM recently identified three key financial challenges still faced by Malaysians: poor financial management, saving habits, and digital financial literacy.

61% Difficult To Come Up With RM1,000 For Emergency - remains a concerning issue, with the survey revealing that one in four Malaysians feels their debt is burdensome, while wide access to financial services such as having a deposit account does not translate into meaningful saving habits and usage. According to the same survey, 61 per cent of Malaysians would have difficulty to come up with RM1,000 in case of an emergency.

Low level of digital financial literacy was highlighted by the survey, with 15 per cent of the population, mostly teenagers, sharing their banking passwords. This practice exposes them to the increasing rate of online scams and being used as money mules.

Sunday, November 17, 2024

Apex Court Rules For Claimant

The Federal Court has in a landmark decision ruled that a passenger travelling in a vehicle on work matters can recover compensation from the vehicle’s insurers for injuries suffered in the event of an accident - under Section 91(1)(b)(bb) of the Road Transport Act 1987 (RTA) protects third party accident victims who travel in an insured motor vehicle for work engagements.

A three-member bench which unanimously allowed an appeal by Chen Boon Kwee from a Court of Appeal ruling favouring Berjaya Sompo Insurance Berhad. Chen, a passenger in a Toyota Camry car owned by his wife, Tan Saw Kheng, and driven by Masri Tamin, sustained injuries in a road accident in 2015.

He obtained judgment against Masri and Tan in the Batu Pahat sessions court five years ago and sought to enforce it on Berjaya Sompo, the vehicle’s insurer under a third-party risk motor insurance policy.

Berjaya Sompo sought to disclaim liability for the judgment on grounds that the policy did not cover members of the vehicle owner’s household. The bench, chaired by Zabariah, also awarded Chen RM150,000 in costs.

Overturned Court Of Appeal Ruling - In its decision, the apex court also overturned the Court of Appeal’s ruling that an injured passenger who has already obtained judgment against an insured vehicle owner must bring a separate “recovery action” to enforce his claim against the vehicle’s insurer.

Chen was injured when the car he was in collided with a lorry on the Pagoh-Yong Peng highway. In 2019, the sessions court awarded him damages of RM200,000 after holding Masri solely responsible for the accident. The court also found Tan vicariously liable in her capacity as owner of the car.

The judgment was upheld by the High Court. Berjaya Sompo then filed a separate action in the High Court seeking a declaration that Chen was obliged to file a recovery suit to prove that he was covered under the policy before the judgment could be enforced on the company.

Both the High Court and the Court of Appeal found in the insurer’s favour, leading to the present appeal which saw the lower courts’ ruling overturned.

A three-member bench which unanimously allowed an appeal by Chen Boon Kwee from a Court of Appeal ruling favouring Berjaya Sompo Insurance Berhad. Chen, a passenger in a Toyota Camry car owned by his wife, Tan Saw Kheng, and driven by Masri Tamin, sustained injuries in a road accident in 2015.

He obtained judgment against Masri and Tan in the Batu Pahat sessions court five years ago and sought to enforce it on Berjaya Sompo, the vehicle’s insurer under a third-party risk motor insurance policy.

Berjaya Sompo sought to disclaim liability for the judgment on grounds that the policy did not cover members of the vehicle owner’s household. The bench, chaired by Zabariah, also awarded Chen RM150,000 in costs.

Overturned Court Of Appeal Ruling - In its decision, the apex court also overturned the Court of Appeal’s ruling that an injured passenger who has already obtained judgment against an insured vehicle owner must bring a separate “recovery action” to enforce his claim against the vehicle’s insurer.

Chen was injured when the car he was in collided with a lorry on the Pagoh-Yong Peng highway. In 2019, the sessions court awarded him damages of RM200,000 after holding Masri solely responsible for the accident. The court also found Tan vicariously liable in her capacity as owner of the car.

The judgment was upheld by the High Court. Berjaya Sompo then filed a separate action in the High Court seeking a declaration that Chen was obliged to file a recovery suit to prove that he was covered under the policy before the judgment could be enforced on the company.

Both the High Court and the Court of Appeal found in the insurer’s favour, leading to the present appeal which saw the lower courts’ ruling overturned.

Sunday, November 10, 2024

India Life Insurance Industry Crisis Ahead

The widespread financial irregularities and mismanagement plaguing our life insurance firms, which have put the entire industry at risk, are alarming. According to data from the Insurance Development and Regulatory Authority (IDRA), 31 out of 36 life insurers are yet to settle about 11 lakh policyholders' claims worth Tk 3,643 crore—with clients remaining uncertain as to when they will get their money back.

Mounting Problems - Experts say that poor investment decisions, high agent commissions, excessive management costs, and unhealthy competition are to blame for this. The situation has particularly worsened in recent years, with IDRA data showing that the claim settlement rate among life insurers dropped from 85 percent in 2020 to 72 percent in 2023. Moreover, of the 31 insurance companies with unsettled claims, nine have the worst settlement rates.

Mounting Problems - Experts say that poor investment decisions, high agent commissions, excessive management costs, and unhealthy competition are to blame for this. The situation has particularly worsened in recent years, with IDRA data showing that the claim settlement rate among life insurers dropped from 85 percent in 2020 to 72 percent in 2023. Moreover, of the 31 insurance companies with unsettled claims, nine have the worst settlement rates.

For example, Fareast Islami Life recorded Tk 2,577 crore in claims but paid just Tk 32 crore. Similarly, Padma Islami Life paid only Tk 4 crore against Tk 226 crore in claims, Progressive Life Insurance settled Tk 6 crore of Tk 174 crore in claims, Sunflower Life Insurance settled Tk 2 crore of Tk 141 crore, and BAIRA Life Insurance paid Tk 2 crore of Tk 67 crore in claims.

According to the Insurance Act of 2010, claims must be settled within 90 days of submitting all required documentation after a policy matures. However, the fact that policyholders are struggling to get their money back for much longer is entirely unacceptable. Additionally, the amount and types of irregularities that are to blame for this are staggering.

According to the Insurance Act of 2010, claims must be settled within 90 days of submitting all required documentation after a policy matures. However, the fact that policyholders are struggling to get their money back for much longer is entirely unacceptable. Additionally, the amount and types of irregularities that are to blame for this are staggering.

Political Interference - Yet, regulators reportedly never took any major steps against these companies due to political reasons and legal limitations. That political constraints limited regulators' ability to do their jobs seems to have become a common excuse now across industries. As a result, however, it is the ordinary people that are now struggling. But should the concerned authorities be let off the hook for their failure to perform their duties and protect citizens? And what about those who were directly responsible for the corruption in this sector? It is incumbent upon the government to identify those who are directly responsible for such irregularities and mismanagement and hold them accountable.

Moreover, the government needs to develop a comprehensive strategy to ensure that clients recover their money from these companies. This should include taking legal action against directors involved in financial irregularities and confiscating their assets. The government should also consider monetising the fixed assets of corrupt companies to settle claims.

Clearly, mismanagement in the sector has led to a significant loss of credibility. Therefore, the government should involve experts and other stakeholders to fully reform the sector and ensure that regulators are empowered to effectively oversee it in the future.

Moreover, the government needs to develop a comprehensive strategy to ensure that clients recover their money from these companies. This should include taking legal action against directors involved in financial irregularities and confiscating their assets. The government should also consider monetising the fixed assets of corrupt companies to settle claims.

Clearly, mismanagement in the sector has led to a significant loss of credibility. Therefore, the government should involve experts and other stakeholders to fully reform the sector and ensure that regulators are empowered to effectively oversee it in the future.

Saturday, November 9, 2024

Allianz Mulling Existing India Bajaj JV

India Bajaj Finserv announced on Tuesday that Germany's Allianz SE is considering exiting their joint ventures in life and general insurance, a partnership that has spanned over two decades, reported Reuters.

Bajaj Finserv, which holds a 74% stake in both joint ventures, disclosed that Allianz, holding the remaining 26%, has signalled its intent to divest as part of its shifting strategic priorities.

Established in 2001, Bajaj Allianz General Insurance ranks amongst India’s largest private insurers, whilst Bajaj Allianz Life Insurance is one of the country's fastest-growing life insurers, managing assets worth over $11.89b.

Bajaj Finserv, which holds a 74% stake in both joint ventures, disclosed that Allianz, holding the remaining 26%, has signalled its intent to divest as part of its shifting strategic priorities.

Established in 2001, Bajaj Allianz General Insurance ranks amongst India’s largest private insurers, whilst Bajaj Allianz Life Insurance is one of the country's fastest-growing life insurers, managing assets worth over $11.89b.

Taiwan Life Insurer Switch To Protection Product

Life insurers in Taiwan have shifted their focus towards sales of protection-type products and continued to strengthen their capitalization. Taiwan Life Insurance is expected to push accident and health insurance products with higher and sustainable contractual service margins. These products posted a 16% y-o-y increase in first-year premiums in 9M2024. US Fed rate cuts may drive more demand for US dollar-denominated variable-interest life insurance products. An ability to balance premium growth and margin expansion will differentiate insurers’ credit profiles.

Most life insurers' profitability improved notably in 1H2024 from 1H2023 on stronger new business margin and investment returns on stock market performance. The new foreign currency volatility reserve system announced by the Financial Supervisory Commission of Taiwan in August 2024 allows more operational flexibility to manage hedging costs.

Insurers will continue to issue either onshore or offshore bonds through wholly owned special purpose vehicles (SPVs) overseas (which count towards capital), to prepare for TW-ICS, the upcoming new regulatory solvency regime with higher standards on capital requirements.

Most life insurers' profitability improved notably in 1H2024 from 1H2023 on stronger new business margin and investment returns on stock market performance. The new foreign currency volatility reserve system announced by the Financial Supervisory Commission of Taiwan in August 2024 allows more operational flexibility to manage hedging costs.

Insurers will continue to issue either onshore or offshore bonds through wholly owned special purpose vehicles (SPVs) overseas (which count towards capital), to prepare for TW-ICS, the upcoming new regulatory solvency regime with higher standards on capital requirements.

Wednesday, November 6, 2024

Independent Distributor Versus Captive Agent

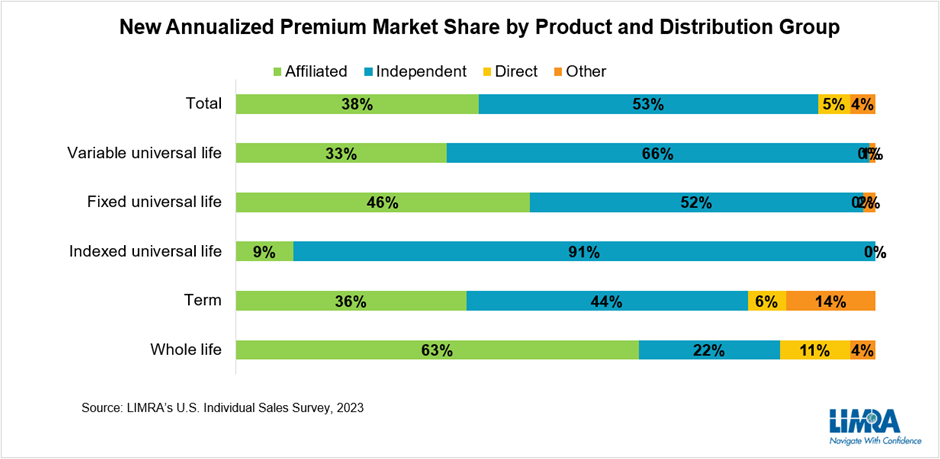

In 1999, affiliated distribution and independent distribution sold approximately equal amounts of new premium (48% vs 47%). As the number of independent agents grew and surpassed the number of affiliated agents, the distribution of life insurance sales shifted with independent distribution becoming the leading channel.

In 2023, independent distribution market share made up 53% percent of all U.S. life insurance new premium sold, compared to just 38% from affiliated agents.In every product line except whole life, independent distribution represents the largest premium market share and this is driving the growth in the industry. Total new premium sold in 1999 was $9.3 billion. The expansion of independent distribution has propelled new premium to top $15.6 billion last year.

As an example, indexed universal life (UL) new premium, which was negligible in 2011, now represents a quarter of new premium sold today. Independent distribution sells more than 90% of IUL premium. Independent channels also sell a majority of fixed UL and variable UL premium. Even for whole life premium — which remains predominantly sold by affiliated agents — market share for independent channels has jumped nine points in the past decade.

In light of these sales trends, it is clear that all life insurers have to develop multi-channel strategies to remain competitive. Part of that strategy involves building strong relationships with intermediaries, which represent thousands of independent agents.

The Role Of The Intermediary

Intermediaries — primarily independent market organizations (IMOs) and brokerage general agencies (BGAs) — play an essential role with independent financial professionals by helping them build and grow their practices, acting as the expert go-between for financial professionals and carriers. Among the services they offer to agents include training and development, marketing and technology support, underwriting support and case management, and a product platform — vetting products and carriers for their network to sell. In other words, their relationship with carriers has a big impact on what independent agents sell to their clients.

Top Intermediary Priorities

Research shows the top three reasons intermediaries place business with a specific carrier are pricing, underwriting/sales support, and compensation. While pricing and compensation are largely proprietary to each carrier, there is a lot of room to build a competitive edge through sales support.

Intermediaries are asked - what types of support carriers could provide to help drive growth. Their responses fell into three main themes:

In 2023, independent distribution market share made up 53% percent of all U.S. life insurance new premium sold, compared to just 38% from affiliated agents.In every product line except whole life, independent distribution represents the largest premium market share and this is driving the growth in the industry. Total new premium sold in 1999 was $9.3 billion. The expansion of independent distribution has propelled new premium to top $15.6 billion last year.

As an example, indexed universal life (UL) new premium, which was negligible in 2011, now represents a quarter of new premium sold today. Independent distribution sells more than 90% of IUL premium. Independent channels also sell a majority of fixed UL and variable UL premium. Even for whole life premium — which remains predominantly sold by affiliated agents — market share for independent channels has jumped nine points in the past decade.

In light of these sales trends, it is clear that all life insurers have to develop multi-channel strategies to remain competitive. Part of that strategy involves building strong relationships with intermediaries, which represent thousands of independent agents.

The Role Of The Intermediary

Intermediaries — primarily independent market organizations (IMOs) and brokerage general agencies (BGAs) — play an essential role with independent financial professionals by helping them build and grow their practices, acting as the expert go-between for financial professionals and carriers. Among the services they offer to agents include training and development, marketing and technology support, underwriting support and case management, and a product platform — vetting products and carriers for their network to sell. In other words, their relationship with carriers has a big impact on what independent agents sell to their clients.

Top Intermediary Priorities

Research shows the top three reasons intermediaries place business with a specific carrier are pricing, underwriting/sales support, and compensation. While pricing and compensation are largely proprietary to each carrier, there is a lot of room to build a competitive edge through sales support.

Intermediaries are asked - what types of support carriers could provide to help drive growth. Their responses fell into three main themes:

a: Faster and easier underwriting processes;

b: Direct contact to home office personnel that can resolve issues immediately – which

b: Direct contact to home office personnel that can resolve issues immediately – which

means build a strong internal and external wholesaling program; and

c: Offering competitive and innovative products that will perform well in the long run.

These themes are echoed in other studies of experienced financial professionals. The top reason experienced financial professionals give for placing business with a carrier is because the carrier offers a strong sales process that provides a positive experience for the sales professional. Carriers that invest in making the process easier may be able to overcome slight pricing and compensation disadvantages.

Where Technology Can Help

The industry has already made significant process expanding digital services such as e-signature, e-delivery, automated underwriting, etc., streamlining the process and lowering costs. As new technologies, particularly artificial intelligence (AI), become more readily available, intermediaries are hopeful it can cut costs and improve productivity.

Research indicated 65% of intermediaries say the cost of distribution is increasing and are looking to technology to mitigate rising costs. Investments in technology span from marketing and sales enablement to data analytics, cybersecurity and compliance. Nearly 4 in 10 intermediaries agree that ChatGPT and AI will become an essential tool for BGAs and IMOs and how they do business.

This push to modernize and use technology will help address the growing U.S. life insurance need gap. Four in 10 American adults say their families would face financial hardship should the primary wage earner die unexpectedly. Making it easier and quicker for independent agents to engage today’s consumer and help them get the coverage they need is a worthy goal.

These themes are echoed in other studies of experienced financial professionals. The top reason experienced financial professionals give for placing business with a carrier is because the carrier offers a strong sales process that provides a positive experience for the sales professional. Carriers that invest in making the process easier may be able to overcome slight pricing and compensation disadvantages.

Where Technology Can Help

The industry has already made significant process expanding digital services such as e-signature, e-delivery, automated underwriting, etc., streamlining the process and lowering costs. As new technologies, particularly artificial intelligence (AI), become more readily available, intermediaries are hopeful it can cut costs and improve productivity.

Research indicated 65% of intermediaries say the cost of distribution is increasing and are looking to technology to mitigate rising costs. Investments in technology span from marketing and sales enablement to data analytics, cybersecurity and compliance. Nearly 4 in 10 intermediaries agree that ChatGPT and AI will become an essential tool for BGAs and IMOs and how they do business.

This push to modernize and use technology will help address the growing U.S. life insurance need gap. Four in 10 American adults say their families would face financial hardship should the primary wage earner die unexpectedly. Making it easier and quicker for independent agents to engage today’s consumer and help them get the coverage they need is a worthy goal.

Developing New Product - Life Insurance

Life and health insurance product development can be extremely rewarding for both insurer and consumer if done right. Handling product development the right way, however, is very challenging. Too often, insurers face obstacles in meeting customer needs over other considerations such as launching a product to outperform the competition or incentivizing distribution via commissions. Coupled with the fact that the shelf life of an insurance product is often short, the typical approach to product development may lower consumer confidence in insurers and the industry.

Since the process is iterative and non-linear, it is possible to return to a preceding principle before completing development. The phases includes:

Since the process is iterative and non-linear, it is possible to return to a preceding principle before completing development. The phases includes:

Empathize with the customer

Define the problem

Ideate

Prototype

Test

Empathize With The Customer

Human beings’ capacity for empathy is one of our most admirable qualities. Product innovators and designers should ensure empathy is kept at the center of design and development. This means putting real customer needs above all.

The key to success for any new product — be it insurance or otherwise — is that it serves the real needs of its target consumers and that they realize the product’s value enough to purchase it.

If product design and benefits are so technical that most laypeople do not understand them, chances are the resulting insurance product will become another push product with a short shelf life.

Feedback from real target consumers through Voice of the Customer (VOC) programs is a great way to identify market needs. When planning VOCs and/or focus group discussions, all elements – from the questions asked to the information sought – need to be thought through. Most importantly, the objective of the exercise should be crystal clear.

Feedback on distribution is equally vital but should be validated from actual target consumers. Influential distribution partners (agents, affinity partners, etc.) often demand a “product” that serves a channel’s interests more than end consumers.

Human beings’ capacity for empathy is one of our most admirable qualities. Product innovators and designers should ensure empathy is kept at the center of design and development. This means putting real customer needs above all.

The key to success for any new product — be it insurance or otherwise — is that it serves the real needs of its target consumers and that they realize the product’s value enough to purchase it.

If product design and benefits are so technical that most laypeople do not understand them, chances are the resulting insurance product will become another push product with a short shelf life.

Feedback from real target consumers through Voice of the Customer (VOC) programs is a great way to identify market needs. When planning VOCs and/or focus group discussions, all elements – from the questions asked to the information sought – need to be thought through. Most importantly, the objective of the exercise should be crystal clear.

Feedback on distribution is equally vital but should be validated from actual target consumers. Influential distribution partners (agents, affinity partners, etc.) often demand a “product” that serves a channel’s interests more than end consumers.

Define The Problem

Empathy leads to understanding and the ability to articulate nuances of target consumers’ real needs in a problem statement. The best way to create this statement is to ask questions, such as:

Empathy leads to understanding and the ability to articulate nuances of target consumers’ real needs in a problem statement. The best way to create this statement is to ask questions, such as:

What are customers’ pain areas?

What are their key drivers for purchasing insurance?

What challenges do they have with existing insurance products?

How likely are they to buy an insurance product should the benefits meet their expectations or needs?

If they were to buy insurance cover for themselves and/or their family – what is the optimal premium price point?

Ideate

With the problem statement defined, it is time to start looking for possible solutions. There could be many solutions to the same problem.

Ideation can happen in various ways – brainstorming, focus group discussions, consultation with experts, etc. The primary objective in this phase should be to explore all possible solutions rather than narrowing down to one right away. Since the design thinking process is iterative/non-linear rather than linear, it is important to validate and reconfirm customer needs with proposed solutions before selecting the best option.

Prototype

After identifying possible solutions, narrow them down to the one or two that best fit the objective. Develop a working product prototype(s) covering possible variants. The prototype(s) should help address all the gaps identified as well as meet end customer needs. Once complete, test within the team or across other teams and departments to gather feedback and fine tune.

With the problem statement defined, it is time to start looking for possible solutions. There could be many solutions to the same problem.

Ideation can happen in various ways – brainstorming, focus group discussions, consultation with experts, etc. The primary objective in this phase should be to explore all possible solutions rather than narrowing down to one right away. Since the design thinking process is iterative/non-linear rather than linear, it is important to validate and reconfirm customer needs with proposed solutions before selecting the best option.

Prototype

After identifying possible solutions, narrow them down to the one or two that best fit the objective. Develop a working product prototype(s) covering possible variants. The prototype(s) should help address all the gaps identified as well as meet end customer needs. Once complete, test within the team or across other teams and departments to gather feedback and fine tune.

Test

Finally, test the prototype with a sample of target consumers through individual feedback or focus group discussions. Every attempt should be made to extract comprehensive feedback on features, design, marketing, price point, and coverage, as well as whether consumers are able to relate to the product.

The keys to success are to experiment, understand the consumer needs clearly, develop appropriate solutions quickly, and be courageous enough to test, fail, adapt, and learn.

By placing the end customer at the center, the resulting paradigm shift in insurance product development could result in rapid business growth and greater insurance penetration.

Below are a few suggestions for consciously keeping the end customer as the central focus – a win-win formula for insurance product development:

Finally, test the prototype with a sample of target consumers through individual feedback or focus group discussions. Every attempt should be made to extract comprehensive feedback on features, design, marketing, price point, and coverage, as well as whether consumers are able to relate to the product.

The keys to success are to experiment, understand the consumer needs clearly, develop appropriate solutions quickly, and be courageous enough to test, fail, adapt, and learn.

By placing the end customer at the center, the resulting paradigm shift in insurance product development could result in rapid business growth and greater insurance penetration.

Below are a few suggestions for consciously keeping the end customer as the central focus – a win-win formula for insurance product development:

1: Ease Of Onboarding

a: End-to-end digital process and infrastructure for seamless sales-to-issuance experience

b: Leveraging data/customer information to pre-populate forms and application materials (subject to applicable data privacy and protection laws)