Would you buy a car for your four-year-old child just because they might need one when they get older? Of course, you wouldn't. But, you know what? Insurance companies want you to do something just as incongruous. Believe it or not, many insurance companies want you to buy life insurance for children, just in case they might need it when they get older.

Would you buy a car for your four-year-old child just because they might need one when they get older? Of course, you wouldn't. But, you know what? Insurance companies want you to do something just as incongruous. Believe it or not, many insurance companies want you to buy life insurance for children, just in case they might need it when they get older.You’ve probably seen the ads on television that artfully target parents and grandparents, encouraging them to buy life insurance for children. Of course, the insurance companies don’t emphasize they are selling life insurance on children. Instead, they cloak the pitch with terms such as a “get started plan,” a “grow up plan” or the favorite, as a “college plan.” No matter how it's couched by the insurance companies, the objective is to make an easy profit by preying on the love of parents or grandparents to sell unneeded life insurance for children.

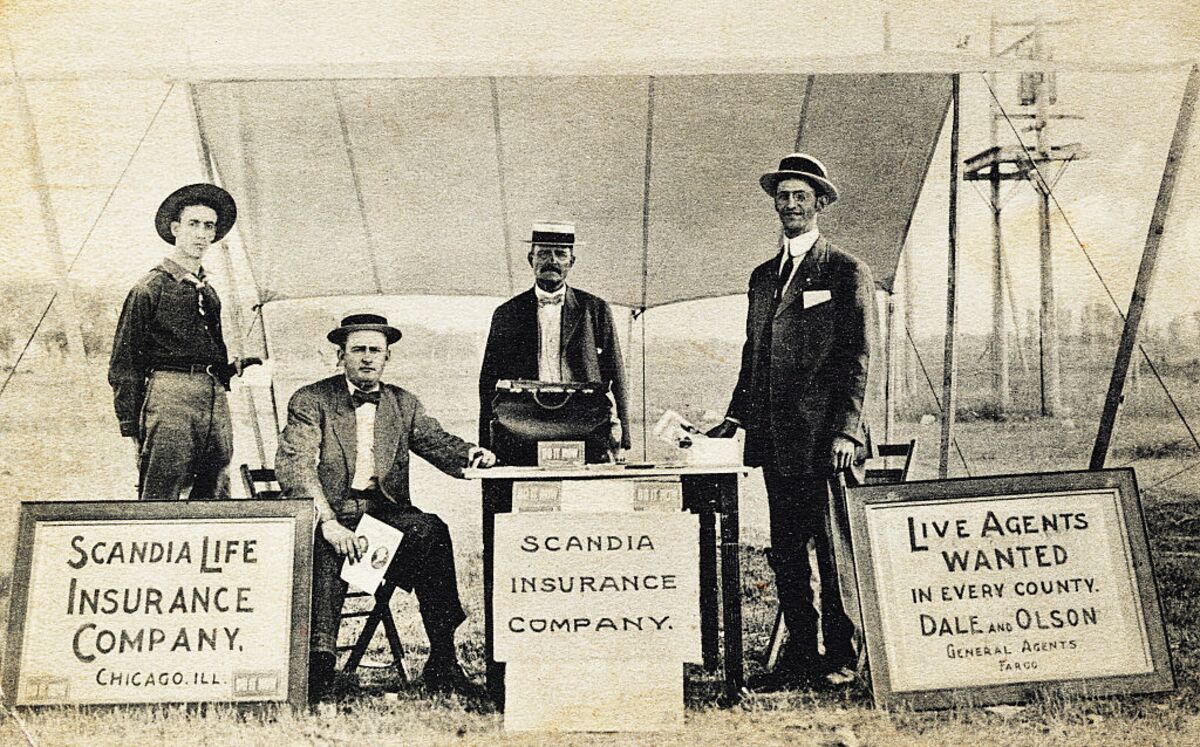

Now, don’t get me wrong, I have nothing against life insurance. After all, I started my career as an agent selling life insurance and ended up as president of one of the largest life insurance companies. I spent my career trying to peddle as much life insurance as I could, but one tactic I always thought was wrong was trying to sell life insurance on children.

Life insurance can be a valuable part of any financial plan but only if it is needed and can serve a useful purpose. The only valid rationale for life insurance is to cover any economic loss that may occur in the event of the death of the insured. Life insurance proceeds can replace lost income for a young family and pay off a mortgage or other debts. It can also stabilize or monetize a small business if a key player should die.

The point is, if no one will experience an economic loss as the result of an individual’s death, there is no need for life insurance. Parents and grandparents will certainly suffer an emotional loss at the rare occurrence of the death of a child, but rarely will this create a debilitating economic loss for the parents or family.