It may seem obvious that once you have determined how much insurance coverage you need, and the life insurance policy that is right for you, picking a beneficiary would be a breeze.

When it comes down to it, however, this decision may prove a difficult one to make. A beneficiary is the person (or persons) you name in your life insurance policy who will receive any death benefits from the policy.

Some companies specify that the choice of a beneficiary should have some stake in your passing. This could be a spouse, child, or other relative. Other insurers are less specific. One's estate can also be named as the beneficiary of a policy. At the time of death, any benefit is split among other assets defined in your will.

One problem with naming your estate as your beneficiary is that proceeds may not be exempt from any creditors who can then lay claim to their portion of the sum. Naming a beneficiary in most cases exempts them from creditors' claims.

Beneficiaries differ. Revocable beneficiaries can be changed whenever you wish while irrevocable beneficiaries cannot be changed without their consent. Changing beneficiaries is as simple as requesting a beneficiary designation form from your insurer, listing the changes you want, signing and dating the form.

There is no legal limit to the number of beneficiaries that can be named. What is important, however, is stating exactly how the proceeds are to be divided among them. Percentages are probably the best way to do this, particularly if one has any interest or dividend adjustments on the policy, which would alter the face value, and subsequently, the final benefit amount.

While the value of the policy changes, the values designated in the percentages allow for distribution of the funds as desired. Naming a minor as a beneficiary requires the appointment of a guardian, or trust, to prevent the probate court from appointing a guardian for you.

It is further important to review one's beneficiaries annually, or when major life events such as marriage, divorce and childbirth occur. In this way, policies are kept updated, and inconvenient surprises avoided.

Sunday, February 24, 2013

Monday, February 18, 2013

An Interesting Article - Life Is Fragile

It was New Year's Eve and I just got off the phone with the insurance company. That conversation took me from the edge of a cliff to the possibility of a future. But a crazy twist of fate could have just as easily pushed me over. My story went back 10 years earlier, to a fateful decision that changed everything.

I met my husband when he was 26 years old. When we met, he was an actor/dancer who truly lived in the moment. He didn't have any money but that was part of his charm. I was entranced by his joie de vivre. As so many of us when we're in love, we ignore the boring, practical side of life and we seized the moment.

I met my husband when he was 26 years old. When we met, he was an actor/dancer who truly lived in the moment. He didn't have any money but that was part of his charm. I was entranced by his joie de vivre. As so many of us when we're in love, we ignore the boring, practical side of life and we seized the moment.

Luckily, I had been brought up to believe you always covered your bases. Those years of childhood lessons nagged at me. I suggested that we both get life insurance. I went ahead but he let the forms sit on the table for months. I know he was thinking that I was being paranoid about money. After all, he was young and what could possibly happen to him. He had been a world class, competitive rowing champ. That made him healthy, strong and invincible.

But cancer doesn't discriminate. Cancer takes whomever it can get. And it got my husband at 26. In the five minutes it took to get the diagnosis, my husband just became ineligible for insurance. If only he had filled out those forms when I asked him to.

We reapplied every single year only to hear that the insurance company felt he was too high risk. Finally, nine years later, one company said yes. What a relief. Having a financial safety net was so important to me. I was about how to find how important.

In what seems to have been a cruel twist of fate, nine months after we received life insurance coverage on Tim's life, his cancer came back. We were stunned. He had been cancer-free for 10 years. How could this be possible? But cancer plays by its own rules and in this case, the truth hit hard. Life had just dealt us a very cruel blow.

Within a year, my husband was dead. Thirty-seven years old, father of a two-and-a-half year old. My world shattered.

What made all the difference to me was that life insurance policy. When I received my check, I cried with relief. That money was my lifeline and I don't want to think about what would have happened without it. It's a frightening thought.

The lesson of the story is an obvious one but it's one so many choose not to hear about. Don't we all wish that our lives would be a series of happy events and happy endings. And most times it is. But what happens when the unexpected drops into your life. Are you ready for it? When I tell my story to women, I remind them that my reality will be their reality one day. The demographics say so.

We have this amazing ability to tell ourselves stories that we want to hear and stories that always have happy endings. But for all of us, sooner or later, there isn't a happy ending. And when that time comes, the happiest ending you can hope for is one which won't devastate you financially.

It is shocking to learn that over one third of Canadians have no life insurance and of widows whose husbands died prematurely, less than 25 per cent of them felt there was inadequate insurance. This adds incredible burden on families at a particularly vulnerable time in life.

Life insurance is as vital to your life as food and shelter. As parents, you owe your children safety and security. Life insurance gives them that. And as parents, when the worst happens, and tragedy has devastated our children's lives, you owe it to them to ensure you don't rip away everything else that matters to them, like their home, their familiar life and parent who is not living in fear of financial survival.

Do yourself and your children a favour. Buy that policy. I can't imagine what my life would have been life if I didn't have that. That is something I definitely don't want to think about.

I met my husband when he was 26 years old. When we met, he was an actor/dancer who truly lived in the moment. He didn't have any money but that was part of his charm. I was entranced by his joie de vivre. As so many of us when we're in love, we ignore the boring, practical side of life and we seized the moment.

I met my husband when he was 26 years old. When we met, he was an actor/dancer who truly lived in the moment. He didn't have any money but that was part of his charm. I was entranced by his joie de vivre. As so many of us when we're in love, we ignore the boring, practical side of life and we seized the moment. Luckily, I had been brought up to believe you always covered your bases. Those years of childhood lessons nagged at me. I suggested that we both get life insurance. I went ahead but he let the forms sit on the table for months. I know he was thinking that I was being paranoid about money. After all, he was young and what could possibly happen to him. He had been a world class, competitive rowing champ. That made him healthy, strong and invincible.

But cancer doesn't discriminate. Cancer takes whomever it can get. And it got my husband at 26. In the five minutes it took to get the diagnosis, my husband just became ineligible for insurance. If only he had filled out those forms when I asked him to.

We reapplied every single year only to hear that the insurance company felt he was too high risk. Finally, nine years later, one company said yes. What a relief. Having a financial safety net was so important to me. I was about how to find how important.

In what seems to have been a cruel twist of fate, nine months after we received life insurance coverage on Tim's life, his cancer came back. We were stunned. He had been cancer-free for 10 years. How could this be possible? But cancer plays by its own rules and in this case, the truth hit hard. Life had just dealt us a very cruel blow.

Within a year, my husband was dead. Thirty-seven years old, father of a two-and-a-half year old. My world shattered.

What made all the difference to me was that life insurance policy. When I received my check, I cried with relief. That money was my lifeline and I don't want to think about what would have happened without it. It's a frightening thought.

The lesson of the story is an obvious one but it's one so many choose not to hear about. Don't we all wish that our lives would be a series of happy events and happy endings. And most times it is. But what happens when the unexpected drops into your life. Are you ready for it? When I tell my story to women, I remind them that my reality will be their reality one day. The demographics say so.

We have this amazing ability to tell ourselves stories that we want to hear and stories that always have happy endings. But for all of us, sooner or later, there isn't a happy ending. And when that time comes, the happiest ending you can hope for is one which won't devastate you financially.

It is shocking to learn that over one third of Canadians have no life insurance and of widows whose husbands died prematurely, less than 25 per cent of them felt there was inadequate insurance. This adds incredible burden on families at a particularly vulnerable time in life.

Life insurance is as vital to your life as food and shelter. As parents, you owe your children safety and security. Life insurance gives them that. And as parents, when the worst happens, and tragedy has devastated our children's lives, you owe it to them to ensure you don't rip away everything else that matters to them, like their home, their familiar life and parent who is not living in fear of financial survival.

Do yourself and your children a favour. Buy that policy. I can't imagine what my life would have been life if I didn't have that. That is something I definitely don't want to think about.

RM6.7 Billion Claims Paid - 2012

A total of RM6.70bil was paid out in life insurance claims in 2012, up 19% from RM5.6bil a year ago, according to the Life Insurance Association of Malaysia (LIAM) - and this includes various types of claims payment namely death, disability, medical and cash bonus payments. An additional amount of RM7.6bil was paid for maturity of policies and cash surrender in 2012.

The association said that as at December 2012, the Malaysian population was covered with RM1.02 trillion sum insured in various forms of life insurance policies. This was 8% higher than the corresponding figure in 2011 of RM946bil. The average sum insured works out to be RM34,700 per capita for 2012, an increase of 6.7% from RM32,533 in 2011.

LIAM noted that investment-linked policies continued to outshine traditional policies in terms of growth with 49.5% of new business share. In 2011, the investment-linked policies formed a lower portion of 45.6% of all new policies sold.

The association said that as at December 2012, the Malaysian population was covered with RM1.02 trillion sum insured in various forms of life insurance policies. This was 8% higher than the corresponding figure in 2011 of RM946bil. The average sum insured works out to be RM34,700 per capita for 2012, an increase of 6.7% from RM32,533 in 2011.

LIAM noted that investment-linked policies continued to outshine traditional policies in terms of growth with 49.5% of new business share. In 2011, the investment-linked policies formed a lower portion of 45.6% of all new policies sold.

Sunday, February 17, 2013

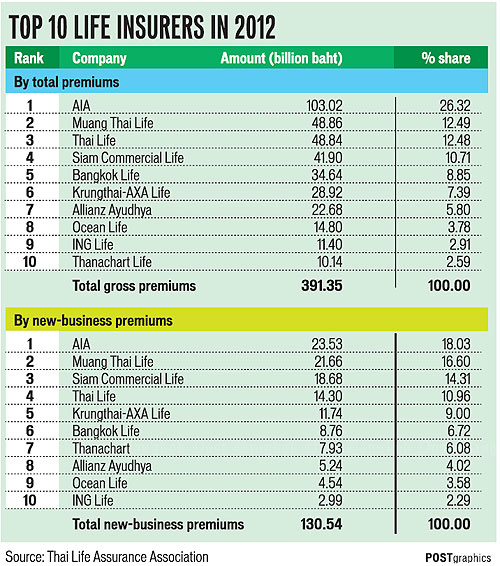

Thailand Life Insurance Surged 19%

Thailand's life insurance industry grew at its highest

rate for 10 years in 2012, with written premiums worth up to 391 billion

baht.

The Thai Life Assurance Association (TLAA) said based on gross premiums, the industry surged 19.1% last year, with new premiums accounting for 131 billion baht, a rise of 32.5%. American International Assurance (AIA), Thailand's largest life insurer, remained the industry leader, controlling 26.3% of the market.

Muang Thai Life Assurance overtook Thai Life Insurance for the first time to take a 12.49% market share, just ahead of Thai Life's 12.48%. SCB Life Assurance was in fourth place with 10.7%, followed by Bangkok Life Assurance at 8.85%.

The other top 10 life insurers were Krungthai-AXA Life Insurance (7.39%), Allianz Ayudhya Assurance (9%), Ocean Life Insurance (3.78%), ING Life (2.91%) and Thanachart Life Assurance (2.59%). The remaining 14 life companies together accounted for only 8.51%.

Measured by new premiums, the market was still led by AIA (18%), followed by Muang Thai Life (16.6%) and SCB Life (14.3%). Thai Life slipped to No.4 with 10.96%.

TLAA director Busara Ungphakorn said the industry's growth rate was driven last year mainly by tailor-made products and insurers' efforts to develop sales teams and promote understanding.

Mrs Busara said the agency channel contributed 57.3% of total premiums or 225 billion baht (up by 11.9%), followed by bancassurance at 36.7% or 144 billion (up by 34.2%). Sales via telephone or telemarketing amounted to 12.1 billion baht or 3.09% (up by 9.4%), while other channels fetched 10.9 billion baht or 2.95% (up by 1.9%).

Friday, February 15, 2013

MAA Indonesia - Sold to Tokio Marine

Japan’s Tokio Marine insurance group has recently acquired a life insurance company to tap into the country’s growing insurance market. Last October, the group completed the acquisition of a majority stake in the now defunct PT MAA Life Assurance — a business unit of Malaysia-based MAA Assurance —and renamed it Tokio Marine Life Insurance Indonesia (TMLII).

The Tokio Marine group currently controls 89 percent ownership of the new firm, while PT Multi Artha Aman holds the remaining 11 percent.

The revamping strategy includes recruiting more agents and opening new offices as well. The company is looking to have around 1,000 agents by the end of 2013, much higher than the 100 it has currently. TMLII currently serves between 12,000 and 15,000 clients, most of whom are former MAA customers. By year-end, it hopes to attract at least 2,000 new clients.

The Tokio Marine group currently controls 89 percent ownership of the new firm, while PT Multi Artha Aman holds the remaining 11 percent.

The revamping strategy includes recruiting more agents and opening new offices as well. The company is looking to have around 1,000 agents by the end of 2013, much higher than the 100 it has currently. TMLII currently serves between 12,000 and 15,000 clients, most of whom are former MAA customers. By year-end, it hopes to attract at least 2,000 new clients.

AmAssurance For Sales

AMMB Holdings Bhd has hired global financial services firm Morgan Stanley to sell about half of its life insurance and takaful operations as it seeks a new partner to expand the business. AMMB could be willing to sell 51% of its insurance division and may price the deal at RM500 million for stakes in AmLife Insurance Bhd and AmTakaful Family Bhd.

The news came on the tail of a Jan 8 announcement that AMMB had repurchased 30% stakes in AmLife and AmFamily Takaful from its joint-venture partner Resolution Ltd for RM245 million.

AmLife has assets totalling RM3 billion at the end of September 2012, and gross earned premiums of RM214.5 million for the half year ending that month. AmTakaful had assets of RM116.2 million and gross premiums of RM14.2 million.

The Malaysian takaful sector is expected to expand at about 20% annually in 2013 and 2014, spurred by awareness and spending by consumers and regulatory reforms to support takaful infrastructure.

The report said takaful’s investment income will be supported by stronger participation and liquidity in sukuk and Shariahcompliant instruments, in addition to the strengthening of takaful and retakaful capacity.

The news came on the tail of a Jan 8 announcement that AMMB had repurchased 30% stakes in AmLife and AmFamily Takaful from its joint-venture partner Resolution Ltd for RM245 million.

AmLife has assets totalling RM3 billion at the end of September 2012, and gross earned premiums of RM214.5 million for the half year ending that month. AmTakaful had assets of RM116.2 million and gross premiums of RM14.2 million.

The Malaysian takaful sector is expected to expand at about 20% annually in 2013 and 2014, spurred by awareness and spending by consumers and regulatory reforms to support takaful infrastructure.

The report said takaful’s investment income will be supported by stronger participation and liquidity in sukuk and Shariahcompliant instruments, in addition to the strengthening of takaful and retakaful capacity.

Tuesday, February 5, 2013

Think Win-Win

TIRED of being broke? The amount of money you have at your disposal is not always dependent on how

much you earn.High-earners are often broke and low earners often seem flushed with

cash.

The secret of not living paycheck-to-paycheck is by following some simple life habits. Frugality doesn’t mean giving up luxury and the things you love but changing your attitude towards money.

Be Proactive

Mr Ning compares the habits of highly frugal people to the seven habits of highly effective people and the first step is to take responsibility. Quit blaming your childhood, your school, your boss or the Government and accept that you are in control of the direction of your life. The more you ignore the situation, the worse it will get.

Begin With The End In Mind

Those who are successful in reaching their goals are those who can envisage them from the beginning. If you don't visualise what you want, then you're at risk of other people and external circumstances influencing your life – because you're not influencing it yourself. You must decide if your goal is to be debt free, build a savings account of a certain value, or live on one income in a two-income household.

Put First Things First

Knowing why you're doing something can help make you do it and that means knowing what is most valuable and worthy to you. It's a lot more difficult to say "no" to something if you don’t know why you're saying no and not focused on what’s important to you. It's easy to spend more than your budgeted amount each month when you put everything before your finances such as "worrying about missing out on a dinner with friends, feel as though you have to cater a birthday party for your son and 50 of his closest friends, or don't want to wear the same suit to a work conference two years in a row."

Think Win-Win

Don't compare yourself to others and constantly compete with others. Instead, it's better to have a win-win mindset which will allow you to see mutual benefits from all your dealings with people and realise that there's enough for everyone to benefit from situations. Don't think "it’s not fair" that others have a better car or a bigger house because you don’t know the whole story – and it could just be a façade for covering their huge debts.

It's important to focus on your own finances and know you’ll get to where you want to be some day.

True wealth is not measured in possessions, but in assets. When the value of your assets is greater than the amount you owe on mortgages, car loans, and credit card debts, then you have a strong net worth and are truly wealthy.

Communication

Listening with the intention to understand can help you reach your goal of frugality. "Don't just wait for your turn to talk; pay attention to what people are trying to tell you. To be effective in your goal of frugality, you need to be able to listen to and understand the goals and behaviours of the other people in your life. If you're saving but your partner is spending like crazy then your behaviours offset each other and you won't reach your goal. Instead understand the needs of the people in your life and work out a way to be more frugal without them having to give up the things that are most important to them.

Synergise

Synergising is the habit of working as a team to get better results than if you were working on your own. When you have genuine interactions with people, you’re able to gain new insights and see new approaches to your problems — ones you might not have thought of before.

Talk to people to discover new ways to do things and processes that can really help you save money. Surrounding yourself with like-minded people can help. Find people who are where you want to be by joining online frugal-living forums, striking up a friendship with a fellow coupon-cutter, or starting a sewing club. When you’re around people with the same goals as you, you’ll be able to share ideas and learn from each other.

Sharpen The Saw

In order to maintain all these habits and achieve any goal in life it's important to look after yourself physically, emotionally, mentally and spiritually. This can be done frugally too by: eating better by starting a vegetable patch; exercise frugally by going for a walk or jog; interacting socially to make you feel better emotionally; exercise your mind by reading or volunteering; and spend time close to nature and expand your spiritual self through meditation, music, art, or prayer.

The secret of not living paycheck-to-paycheck is by following some simple life habits. Frugality doesn’t mean giving up luxury and the things you love but changing your attitude towards money.

Be Proactive

Mr Ning compares the habits of highly frugal people to the seven habits of highly effective people and the first step is to take responsibility. Quit blaming your childhood, your school, your boss or the Government and accept that you are in control of the direction of your life. The more you ignore the situation, the worse it will get.

Begin With The End In Mind

Those who are successful in reaching their goals are those who can envisage them from the beginning. If you don't visualise what you want, then you're at risk of other people and external circumstances influencing your life – because you're not influencing it yourself. You must decide if your goal is to be debt free, build a savings account of a certain value, or live on one income in a two-income household.

Put First Things First

Knowing why you're doing something can help make you do it and that means knowing what is most valuable and worthy to you. It's a lot more difficult to say "no" to something if you don’t know why you're saying no and not focused on what’s important to you. It's easy to spend more than your budgeted amount each month when you put everything before your finances such as "worrying about missing out on a dinner with friends, feel as though you have to cater a birthday party for your son and 50 of his closest friends, or don't want to wear the same suit to a work conference two years in a row."

Think Win-Win

Don't compare yourself to others and constantly compete with others. Instead, it's better to have a win-win mindset which will allow you to see mutual benefits from all your dealings with people and realise that there's enough for everyone to benefit from situations. Don't think "it’s not fair" that others have a better car or a bigger house because you don’t know the whole story – and it could just be a façade for covering their huge debts.

It's important to focus on your own finances and know you’ll get to where you want to be some day.

True wealth is not measured in possessions, but in assets. When the value of your assets is greater than the amount you owe on mortgages, car loans, and credit card debts, then you have a strong net worth and are truly wealthy.

Communication

Listening with the intention to understand can help you reach your goal of frugality. "Don't just wait for your turn to talk; pay attention to what people are trying to tell you. To be effective in your goal of frugality, you need to be able to listen to and understand the goals and behaviours of the other people in your life. If you're saving but your partner is spending like crazy then your behaviours offset each other and you won't reach your goal. Instead understand the needs of the people in your life and work out a way to be more frugal without them having to give up the things that are most important to them.

Synergise

Synergising is the habit of working as a team to get better results than if you were working on your own. When you have genuine interactions with people, you’re able to gain new insights and see new approaches to your problems — ones you might not have thought of before.

Talk to people to discover new ways to do things and processes that can really help you save money. Surrounding yourself with like-minded people can help. Find people who are where you want to be by joining online frugal-living forums, striking up a friendship with a fellow coupon-cutter, or starting a sewing club. When you’re around people with the same goals as you, you’ll be able to share ideas and learn from each other.

Sharpen The Saw

In order to maintain all these habits and achieve any goal in life it's important to look after yourself physically, emotionally, mentally and spiritually. This can be done frugally too by: eating better by starting a vegetable patch; exercise frugally by going for a walk or jog; interacting socially to make you feel better emotionally; exercise your mind by reading or volunteering; and spend time close to nature and expand your spiritual self through meditation, music, art, or prayer.

Monday, February 4, 2013

Takaful Insurance Poised For Growth

The Malaysian takaful sector is expected to grow by 20% per year for the next two years as consumer acceptance grow and regulatory changes provide infrastructure for syariah-compliant insurance.

The Malaysian takaful sector is expected to grow by 20% per year for the next two years as consumer acceptance grow and regulatory changes provide infrastructure for syariah-compliant insurance.According to an industry report, more people and companies will buy into takaful products, providing liquidity in sukuk and syariah-compliant instruments even as the industry is able to increase capacity to cater to the demand.

This increased capacity is in part due to the expected finalisation of the government framework for risk-based capital for Islamic banking and takaful. The industry expects the syariah-compliant framework to be essentially similar to the framework that is currently applied to conventional insurance but will add to the valuation of the takaful sector.

The new framework for Islamic banking and takaful, coupled with the requirements of the Malaysian Competition Act may trigger mergers and acquisitions among takaful players as they attempt to pool capital and size in order to compete in the market.

With just 13% penetration rate for family takaful, there is a healthy latent growth potential for the syariah-compliant product. In comparison, the penetration rate for conventional life insurance is 55% as measured by the number of life policies over population.

A recent report by Fitch Ratings said the introduction of the new framework, as well as market volatility, may affect the earnings stability of insurance and takaful players but also that this can be a good thing. The rating agency said the combination of low market penetration and the entry of more players could accelerate the growth of the market for general and family takaful.

Fitch Ratings took a positive view of Bank Negara Malaysia’s Risk Based Capital framework for the takaful sector, which would align the capital requirement of takaful operators with that of conventional insurers. This also means capitalisation would be more reflective of takaful operators’ risk exposure.

Penetration as a percentage of the gross domestic product (GDP) where takaful’s share is slightly less than 1%, adding that in more mature market the figure would reach between 7% and 8% penetration.

According to the Malaysian Rating Corp Bhd in its report published in June 2012, the new business family contributions grew to RM2.18 billion in 2011, up from RM503 million in 2003.

The rating agency said that in general insurance, takaful’s gross direct contributions grew to RM1.6 billion in 2011, up from RM551 million in 2005.

There are 12 takaful operators licensed under the Takaful Act 1984 to conduct family and/or general takaful business in Malaysia. The companies are AIA AFG Takaful Bhd, AmFamily Takaful Bhd, CIMB Aviva Takaful Bhd, Etiqa Takaful Bhd, Great Eastern Takaful Sdn Bhd, Hong Leong MSIG Takaful Bhd, HSBC Amanah Takaful (M) Sdn Bhd, ING PUBLIC Takaful Ehsan Bhd, MAA Takaful Bhd, Prudential BSN Takaful Bhd, Syarikat Takaful Malaysia Bhd and Takaful Ikhlas Sdn Bhd.

Sunday, February 3, 2013

Rural Doctors

He Taiyu and Xie Ai'e, a couple of rural doctors from Central China's Hubei Province, are famous due to their devotion to taking care of a community of over 600 fishermen for 20 years.

In a special program devoted to "rural doctors" by CCTV since October 2012, He and Xie were listed among the "the ten most selfless rural doctors" nationwide, the only couple to make the ranking. The rural doctors that won awards after being listed ranged from all over China, namely Hubei, Anhui, Jiangxi, Guizhou and Yunnan provinces, Xinjiang Uyghur Autonomous Region, Guangxi Zhuang Autonomous Region, Inner Mongolia Autonomous Region, Tibet and Chongqing.

The couple, both in their 40s, hails from the village of Chuantouju near a city of Honghu. It is a floating village made up of 170 boats, where villagers had to cover over 20 kilometers by boat to get to hospital before 1992, due to the lack of doctors. Once, a pregnant woman died while in labor due to no medical attention being on hand.

Few people would choose to work there given the poor living conditions, even though the village was in dire need of doctors. The situation looked up in 1992, when He and Xie arrived, then at the tender age of 24 and 22 respectively.

The most attractive factor about the job is that it has helped them stay together, for 20 years. The village clinic is on a green dock in the middle of a lake. Its cabin covers an area of less than 10 square meters and stands less than 1.5 meters high.

An electric fan is the only equipment available to help relieve summer heat. They spend each cold and damp winter by sharing more than one thick blanket. The electricity they use is generated by a windmill, which only works in windy weather, and is only enough to power lights and TV 20 days a month.

However, as rustic as the clinic is, with an outpatient room and a ward of four beds, it is of great help to the villagers and receives about 10 patients every day.

The couple have different tasks. He takes care of all illnesses except for gynecological matters and the wife pays house calls, mostly to the elderly and children.

Every time Xie goes out to see a patient, she rows there in a wooden boat, causing He to worry since his wife cannot swim. Therefore, he watches his wife row out every day until she is out of sight and ensures she comes back before dark.

Their combined annual income is just 25,000 yuan ($4022.5). The couple once packed their luggage and planned to leave, but stayed once they realized how much they meant to the fishermen.

"Rural doctors are silently working for people, but their job really counts," once commented Pu Cunxin, a well-known actor and philanthropist.

The total number of rural doctors and health workers is over one million by the end of 2010, according to statistics from the Ministry of Health.

In a special program devoted to "rural doctors" by CCTV since October 2012, He and Xie were listed among the "the ten most selfless rural doctors" nationwide, the only couple to make the ranking. The rural doctors that won awards after being listed ranged from all over China, namely Hubei, Anhui, Jiangxi, Guizhou and Yunnan provinces, Xinjiang Uyghur Autonomous Region, Guangxi Zhuang Autonomous Region, Inner Mongolia Autonomous Region, Tibet and Chongqing.

The couple, both in their 40s, hails from the village of Chuantouju near a city of Honghu. It is a floating village made up of 170 boats, where villagers had to cover over 20 kilometers by boat to get to hospital before 1992, due to the lack of doctors. Once, a pregnant woman died while in labor due to no medical attention being on hand.

Few people would choose to work there given the poor living conditions, even though the village was in dire need of doctors. The situation looked up in 1992, when He and Xie arrived, then at the tender age of 24 and 22 respectively.

The most attractive factor about the job is that it has helped them stay together, for 20 years. The village clinic is on a green dock in the middle of a lake. Its cabin covers an area of less than 10 square meters and stands less than 1.5 meters high.

An electric fan is the only equipment available to help relieve summer heat. They spend each cold and damp winter by sharing more than one thick blanket. The electricity they use is generated by a windmill, which only works in windy weather, and is only enough to power lights and TV 20 days a month.

However, as rustic as the clinic is, with an outpatient room and a ward of four beds, it is of great help to the villagers and receives about 10 patients every day.

The couple have different tasks. He takes care of all illnesses except for gynecological matters and the wife pays house calls, mostly to the elderly and children.

Every time Xie goes out to see a patient, she rows there in a wooden boat, causing He to worry since his wife cannot swim. Therefore, he watches his wife row out every day until she is out of sight and ensures she comes back before dark.

Their combined annual income is just 25,000 yuan ($4022.5). The couple once packed their luggage and planned to leave, but stayed once they realized how much they meant to the fishermen.

"Rural doctors are silently working for people, but their job really counts," once commented Pu Cunxin, a well-known actor and philanthropist.

The total number of rural doctors and health workers is over one million by the end of 2010, according to statistics from the Ministry of Health.

Innovation - A Way Forward

Innovation is the primary force that can catapult a company to market leadership and keep it ahead of its rivals. But as a business grows, you need to keep the spirit of creativity alive — it’s too easy to snuff out the creative spark with a stifling layer of process and bureaucracy.

Innovation is the primary force that can catapult a company to market leadership and keep it ahead of its rivals. But as a business grows, you need to keep the spirit of creativity alive — it’s too easy to snuff out the creative spark with a stifling layer of process and bureaucracy.Successful companies focus on more than just growth, profit and the bottom line. They build in new capabilities, functions or even departments that centre on creative, disruptive and sustainable ventures. Indeed, leading companies today are creating value by innovating their business models and shaping their execution, despite a complex and challenging environment.

If companies are to organize successfully around an “innovation engine” — be it for a specific business model, product, service or management — they must focus on some key principles:

Tailor your strategy to your company

Leaders must factor in their organization’s heritage and cultural values. Consider which aspects of your innovation agenda should be nurtured as part of your overall structure. Whether innovation happens at the corporate, business unit, category or brand level — and regardless of whether you use a B2C or B2C model — consider which critical heritage components should be preserved in your desired culture and then figure out which aspects of the current structure should evolve over time.

Factor in the human component

Next, look at what degree of organizational commitment your executive team and people possess in terms of innovation. In other words, consider the rate of change your organizational structure has been able to absorb recently. What is the appetite for change among your top leaders, given the number and diversity of current strategic initiatives? How can you complement your existing organizational structure in terms of innovation? The answers will help factor in the human component of your innovation infrastructure.

Pair internal structures with outside capabilities

Top companies don’t operate in vacuums — they welcome and blend outside innovation. There’s a lot of work underway on “open innovation,” advocating the creation of external, innovative ecosystems. By considering where innovation interaction points can and should exist between the outside world and internal organizational functions, companies can focus their innovation efforts on high-value projects, while using external resources to their advantage.

Attach rewards to innovation

To help innovation leaders progress, incorporate innovation-based skill sets, values and assets into your organizational structure. By attaching rewards to each new career “step,” you can develop an environment of innovation that rewards everyone, from individual professionals to top corporate leaders. And don’t punish those ideas which fall short – creating an innovative environment requires accepting that not every idea will succeed.

What makes fast-growth companies thrive tells us that the margin between success and failure is very slim: getting it right means getting your focus right.Fast-growth entrepreneurial companies understand innovation better than most. They know that their ability to achieve market leadership is intimately linked to their ability to generate new, profitable ideas. But that doesn’t make innovation any easier.

The rapidity of change in our uncertain business climate, and the connectedness of our global markets, creates a need for continual organizational agility, flexibility and innovation. Your company’s success may depend on it.

Saturday, February 2, 2013

Insurable Interest Or Reject Claim

Under the Insurance Act 1996, a beneficiary or nominee is a person who is named in the policy and he can receive the policy monies from the insurer and give a proper discharge. He may or may not be the real `’beneficiary’ of the policy benefits, depending on who he is and whether additional arrangement has been made to ensure that he also receives the money beneficially.

Those with insurable interests included spouses, parents or children, employers or employees, and debtors or creditors. A nominee with insurable interests is depicted as one who will suffer both mentally, emotionally, and financially when the insured dies. The insured has every right to name anyone as a nominee so long as the nominee commands an insurable interest.

39-year-old Paw Gin Bin who was initially thought to be a victim of a hit-and-run accident on a remote road in Sibu Jaya at 6.30pm last Sept 26. Suspicions over his death surfaced after family members of Paw, an odd job worker who also sold lottery result slips, discovered that he had bought insurance policies with compensations totalling RM700,000 a few months earlier and had named a stranger as his nominee.

After getting the court order, police exhumed his body and the one-hour post mortem at Sibu Hospital mortuary on Jan 30 suggested Paw’s chest had been run over by the tyre of a car.

Those with insurable interests included spouses, parents or children, employers or employees, and debtors or creditors. A nominee with insurable interests is depicted as one who will suffer both mentally, emotionally, and financially when the insured dies. The insured has every right to name anyone as a nominee so long as the nominee commands an insurable interest.

39-year-old Paw Gin Bin who was initially thought to be a victim of a hit-and-run accident on a remote road in Sibu Jaya at 6.30pm last Sept 26. Suspicions over his death surfaced after family members of Paw, an odd job worker who also sold lottery result slips, discovered that he had bought insurance policies with compensations totalling RM700,000 a few months earlier and had named a stranger as his nominee.

After getting the court order, police exhumed his body and the one-hour post mortem at Sibu Hospital mortuary on Jan 30 suggested Paw’s chest had been run over by the tyre of a car.

Subscribe to:

Posts (Atom)