Thailand's life insurance industry grew at its highest

rate for 10 years in 2012, with written premiums worth up to 391 billion

baht.

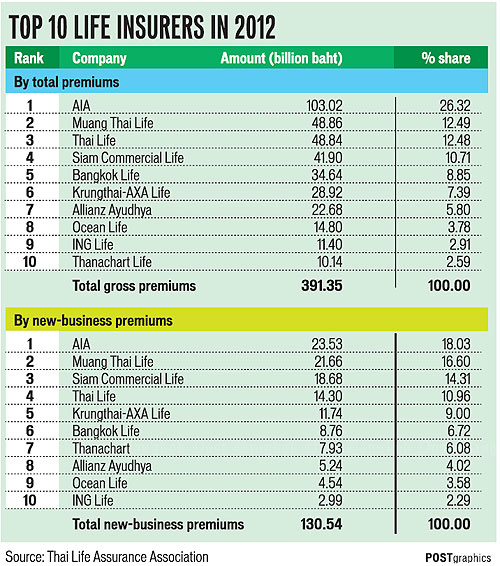

The Thai Life Assurance Association (TLAA) said based on gross premiums, the industry surged 19.1% last year, with new premiums accounting for 131 billion baht, a rise of 32.5%. American International Assurance (AIA), Thailand's largest life insurer, remained the industry leader, controlling 26.3% of the market.

Muang Thai Life Assurance overtook Thai Life Insurance for the first time to take a 12.49% market share, just ahead of Thai Life's 12.48%. SCB Life Assurance was in fourth place with 10.7%, followed by Bangkok Life Assurance at 8.85%.

The other top 10 life insurers were Krungthai-AXA Life Insurance (7.39%), Allianz Ayudhya Assurance (9%), Ocean Life Insurance (3.78%), ING Life (2.91%) and Thanachart Life Assurance (2.59%). The remaining 14 life companies together accounted for only 8.51%.

Measured by new premiums, the market was still led by AIA (18%), followed by Muang Thai Life (16.6%) and SCB Life (14.3%). Thai Life slipped to No.4 with 10.96%.

TLAA director Busara Ungphakorn said the industry's growth rate was driven last year mainly by tailor-made products and insurers' efforts to develop sales teams and promote understanding.

Mrs Busara said the agency channel contributed 57.3% of total premiums or 225 billion baht (up by 11.9%), followed by bancassurance at 36.7% or 144 billion (up by 34.2%). Sales via telephone or telemarketing amounted to 12.1 billion baht or 3.09% (up by 9.4%), while other channels fetched 10.9 billion baht or 2.95% (up by 1.9%).

No comments:

Post a Comment