The Financial Markets Authority have taken court action against AIA based on three core breaches, regarding incorrect and misleading communication to customers holding various life insurance and associated policies.

This includes charging premiums on cancelled policies, treating policies as if they were terminated when they should have remained in force and some customers being charged excess premiums because AIA miscalculated inflation adjustments.

AIA's behaviour exacerbated and prolonged the harm to customers who were already in vulnerable circumstances. Customers took out insurance to reduce stress and financial impact in a time of significant hardship and uncertainty, but when some of them needed the cover they thought they had, it was denied.

The FMA said AIA has admitted the breaches at an early stage, and the matter would now proceed directly to a penalty hearing before the High Court in Auckland, thus avoiding the necessity and cost of a trial. The watchdog would seek a penalty of $700,000.

Friday, July 30, 2021

Tuesday, July 27, 2021

Costly Covid Treatment

As coronavirus cases ravaged India this spring, Anil Sharma visited his 24-year-old son Saurav at a private hospital in northwest New Delhi every day for more than two months. In May, as India’s new COVID-19 cases broke global records to reach 400,000 a day, Saurav was put on a ventilator.

The sight of the tube running into Saurav’s throat is seared in Sharma’s mind. “I had to stay strong when I was with him, but immediately after, I would break down as soon as I left the room,” he said. Saurav is home now, still weak and recovering. But the family’s joy is tempered by a mountain of debt that piled up while he was sick.

Life has been tentatively returning to normal in India as coronavirus cases have fallen. But millions are now facing a huge mountain of medical bills, leaving them in debt as most Indians do not have health insurance.

Sharma exhausted his savings paying for an ambulance, tests, medicines and an ICU bed. Then he took out bank loans. As the costs mounted, he borrowed from friends and relatives. Then he turned to strangers, pleading online for help on Ketto, an Indian crowdfunding website.

$50,000 Medical Cost - Overall, Sharma says he has paid more than $50,000 in medical bills. Although he received $28,000 through the crowdfunding platform he still needs to repay his lenders $26,000.

“He was struggling for his life and we were struggling to provide him an opportunity to survive,” he said, his voice thick with emotion. “I was a proud father – and now I have become a beggar.”

The pandemic has devastated India’s economy, bringing financial calamity to millions at the mercy of its chronically underfunded and fragmented healthcare system. Experts say such costs are bound to hinder an economic recovery.

Even before the pandemic, healthcare access in India was a problem - Indians pay about 63 percent of their medical expenses out-of-pocket. That is typical of many poor countries with inadequate government services.

Data on global personal medical costs from the pandemic is hard to come by but in India and many other countries, treatment for COVID-19 is a huge added burden at a time when hundreds of millions of jobs have vanished.

In India, many jobs returned as cities opened up after a severe lockdown in March 2020, but economists worry about the loss of some 12 million salaried positions. Sharma’s job as a marketing professional was one of them.

When he asked his son’s friends to set up the campaign on Ketto to raise funds, Sharma had not seen a paycheck in 18 months.

Between April and June this year, 40 percent of the 4,500 COVID-19 campaigns on the site were for hospitalisation costs, the company said.

32 million Indians out of middle class - The pandemic has driven 32 million Indians out of the middle class, defined as those earning $10 to $20 a day, according to a Pew Research Center study published in March.

It estimated the crisis has increased the number of India’s poor – those with incomes of $2 or less a day – by 75 million. If you’re looking at what pushes people into debt or poverty, the top two sources often are out-of-pocket health expenditure and catastrophic costs of treatment.

The sight of the tube running into Saurav’s throat is seared in Sharma’s mind. “I had to stay strong when I was with him, but immediately after, I would break down as soon as I left the room,” he said. Saurav is home now, still weak and recovering. But the family’s joy is tempered by a mountain of debt that piled up while he was sick.

Life has been tentatively returning to normal in India as coronavirus cases have fallen. But millions are now facing a huge mountain of medical bills, leaving them in debt as most Indians do not have health insurance.

Sharma exhausted his savings paying for an ambulance, tests, medicines and an ICU bed. Then he took out bank loans. As the costs mounted, he borrowed from friends and relatives. Then he turned to strangers, pleading online for help on Ketto, an Indian crowdfunding website.

$50,000 Medical Cost - Overall, Sharma says he has paid more than $50,000 in medical bills. Although he received $28,000 through the crowdfunding platform he still needs to repay his lenders $26,000.

“He was struggling for his life and we were struggling to provide him an opportunity to survive,” he said, his voice thick with emotion. “I was a proud father – and now I have become a beggar.”

The pandemic has devastated India’s economy, bringing financial calamity to millions at the mercy of its chronically underfunded and fragmented healthcare system. Experts say such costs are bound to hinder an economic recovery.

Even before the pandemic, healthcare access in India was a problem - Indians pay about 63 percent of their medical expenses out-of-pocket. That is typical of many poor countries with inadequate government services.

Data on global personal medical costs from the pandemic is hard to come by but in India and many other countries, treatment for COVID-19 is a huge added burden at a time when hundreds of millions of jobs have vanished.

In India, many jobs returned as cities opened up after a severe lockdown in March 2020, but economists worry about the loss of some 12 million salaried positions. Sharma’s job as a marketing professional was one of them.

When he asked his son’s friends to set up the campaign on Ketto to raise funds, Sharma had not seen a paycheck in 18 months.

Between April and June this year, 40 percent of the 4,500 COVID-19 campaigns on the site were for hospitalisation costs, the company said.

32 million Indians out of middle class - The pandemic has driven 32 million Indians out of the middle class, defined as those earning $10 to $20 a day, according to a Pew Research Center study published in March.

It estimated the crisis has increased the number of India’s poor – those with incomes of $2 or less a day – by 75 million. If you’re looking at what pushes people into debt or poverty, the top two sources often are out-of-pocket health expenditure and catastrophic costs of treatment.

In the northeastern city of Imphal, 2,400 kilometres (1,490 miles) away, Diana Khumanthem lost her mother and sister to the virus in May. Treatment costs wiped out the family’s savings, and when the private hospital where her sister died would not release her body for last rites until a bill of about $5,000 was paid, she pawned the family’s gold jewellery to moneylenders.

When that was not enough, asked her friends, relatives and her sister’s colleagues for help. She still owes some $1,000.

A health insurance scheme - launched by Prime Minister Narendra Modi in 2018 was intended to cover around 500 million of India’s 1.3 billion people and was a significant step towards easing medical costs.

But it does not cover the primary care and outpatient costs that comprise most out-of-pocket expenses. So it has not “effectively improved access to care and financial risk protection."

The program also has been hobbled by disparities in how various states implemented it. Another paper, found costs of ICU hospitalisation for COVID-19 are equivalent to nearly 16 months of work for a typical Indian day labourer or seven to 10 months for salaried or self-employed workers.

Meagre funding of healthcare, at just 1.6 percent of India’s gross domestic product (GDP), is less, proportionately, than what Laos or Ethiopia spends.

At the outbreak’s peak in May, hospitals everywhere were overrun but public facilities lacked the resources to handle the floods of patients coming in. The result is a suffering public health system, where the provision of care is often poor, prompting many to flock to private hospitals.

A public hospital treated Khumanthem’s mother but her sister Ranjita was admitted to a private one that cost $1,300 per day. Ranjita was the family’s only breadwinner after Khumanthem left her nursing job last year to return home during the first wave of the virus. She is now hunting for work while looking after her father and her sister’s three-year-old son.

At her home in Imphal, Khumanthem grieved for her mother by remembering her favourite food – “chagem pomba”, a type of gruel made with vegetables, rice and soybeans. Every few minutes, she looked towards the front gate.

“This is usually the time Ranjita would return home from work,” she said. “I still keep thinking she could walk through the gate any moment now.”

Back in New Delhi, Sharma sighed in relief as an ambulance brought his son home from the hospital last week. Saurav needs physiotherapy to build up his weakened muscles, a daily nurse and a long list of medications. It may be weeks before he will be able to stand on his own and months before the ambitious lawyer who was one of the top students in his class, will be able to go to court again. The costs will continue. “Our first priority was to save him,” Sharma said. “Now we will need to figure out the rest.”

When that was not enough, asked her friends, relatives and her sister’s colleagues for help. She still owes some $1,000.

A health insurance scheme - launched by Prime Minister Narendra Modi in 2018 was intended to cover around 500 million of India’s 1.3 billion people and was a significant step towards easing medical costs.

But it does not cover the primary care and outpatient costs that comprise most out-of-pocket expenses. So it has not “effectively improved access to care and financial risk protection."

The program also has been hobbled by disparities in how various states implemented it. Another paper, found costs of ICU hospitalisation for COVID-19 are equivalent to nearly 16 months of work for a typical Indian day labourer or seven to 10 months for salaried or self-employed workers.

Meagre funding of healthcare, at just 1.6 percent of India’s gross domestic product (GDP), is less, proportionately, than what Laos or Ethiopia spends.

At the outbreak’s peak in May, hospitals everywhere were overrun but public facilities lacked the resources to handle the floods of patients coming in. The result is a suffering public health system, where the provision of care is often poor, prompting many to flock to private hospitals.

A public hospital treated Khumanthem’s mother but her sister Ranjita was admitted to a private one that cost $1,300 per day. Ranjita was the family’s only breadwinner after Khumanthem left her nursing job last year to return home during the first wave of the virus. She is now hunting for work while looking after her father and her sister’s three-year-old son.

At her home in Imphal, Khumanthem grieved for her mother by remembering her favourite food – “chagem pomba”, a type of gruel made with vegetables, rice and soybeans. Every few minutes, she looked towards the front gate.

“This is usually the time Ranjita would return home from work,” she said. “I still keep thinking she could walk through the gate any moment now.”

Back in New Delhi, Sharma sighed in relief as an ambulance brought his son home from the hospital last week. Saurav needs physiotherapy to build up his weakened muscles, a daily nurse and a long list of medications. It may be weeks before he will be able to stand on his own and months before the ambitious lawyer who was one of the top students in his class, will be able to go to court again. The costs will continue. “Our first priority was to save him,” Sharma said. “Now we will need to figure out the rest.”

Saturday, July 24, 2021

Dabbawala Disrupted By Covid

After the pandemic shut offices and put Mumbai’s renowned lunchbox deliverymen out of work, the 130-year-old “dabbawala” network has tied up with a trendy restaurant chain to take on India’s billion-dollar start-ups. For two decades, neither terror attacks nor monsoon deluges could stop Kailash Shinde from delivering hot lunches to Mumbai office workers, until lockdowns put dabbawala network on a forced hiatus for a whole year.

Instantly recognizable in its traditional Gandhi cap and white Indian attire, the 5,000 dabbawalas — or “lunchbox men” in Hindi - have gained global recognition for delivering home-cooked food with clockwork precision. An intricate system of alphanumeric codes helps the largely semi-literate or illiterate workforce collect, sort and distribute 200,000 meals across Mumbai each day via bicycles, hand carts and a sprawling local train network.

Their work has been studied as a “model of service excellence” at Harvard Business School, and inspired personal visits from Richard Branson, Prince Charles and executives from global delivery giants FedEx and Amazon, among others.

But with extended lockdowns forcing millions of Mumbai’s white-collar professionals to work from home, many dabbawalas have been struggling to feed their own families since April last year.

Mumbai’s original deliverymen - But delivery jobs are harder to come by in a space now increasingly dominated by mobile apps, especially for its member who can’t read or write.

Help arrived this May in the form of a tie-up with some of Mumbai’s most popular eateries, allowing members to return to work. Instead of handling home-cooked meals packed in stainless steel tiffin boxes, Member is now delivering restaurant staples from nachos to spaghetti carbonara to time-starved professionals as they continue working from home for a second year.

The scheme offers restaurateurs an alternative to the prevailing local duopoly of delivery giants Zomato and Swiggy, whose steep discounts and razor-thin margins have slashed their profits.

A new beginning - Restaurants plan to expand his partnership with the dabbawalas, but analysts say that alone may not be enough to help the famed deliverymen survive the pandemic. The dabbawalas could become delivery agents for last-mile delivery not just for restaurants but also for any e-commerce business.

But a lack of literacy means many of them are reluctant to take on work that requires tech-savvy skills.

Instantly recognizable in its traditional Gandhi cap and white Indian attire, the 5,000 dabbawalas — or “lunchbox men” in Hindi - have gained global recognition for delivering home-cooked food with clockwork precision. An intricate system of alphanumeric codes helps the largely semi-literate or illiterate workforce collect, sort and distribute 200,000 meals across Mumbai each day via bicycles, hand carts and a sprawling local train network.

Their work has been studied as a “model of service excellence” at Harvard Business School, and inspired personal visits from Richard Branson, Prince Charles and executives from global delivery giants FedEx and Amazon, among others.

But with extended lockdowns forcing millions of Mumbai’s white-collar professionals to work from home, many dabbawalas have been struggling to feed their own families since April last year.

Mumbai’s original deliverymen - But delivery jobs are harder to come by in a space now increasingly dominated by mobile apps, especially for its member who can’t read or write.

Help arrived this May in the form of a tie-up with some of Mumbai’s most popular eateries, allowing members to return to work. Instead of handling home-cooked meals packed in stainless steel tiffin boxes, Member is now delivering restaurant staples from nachos to spaghetti carbonara to time-starved professionals as they continue working from home for a second year.

The scheme offers restaurateurs an alternative to the prevailing local duopoly of delivery giants Zomato and Swiggy, whose steep discounts and razor-thin margins have slashed their profits.

A new beginning - Restaurants plan to expand his partnership with the dabbawalas, but analysts say that alone may not be enough to help the famed deliverymen survive the pandemic. The dabbawalas could become delivery agents for last-mile delivery not just for restaurants but also for any e-commerce business.

But a lack of literacy means many of them are reluctant to take on work that requires tech-savvy skills.

Friday, July 23, 2021

AmGeneral Sold To Liberty

AMMB Holdings Bhd's 51% - owned AmGeneral Holdings Bhd will be disposing of its entire 100% stake in AmGeneral Insurance Bhd (AGIB) to Liberty Insurance Bhd (LIB) for RM2.29 billion, to be satisfied via cash and a 30% stake in LIB.

Upon completion of the proposed disposal, AMMB and Liberty Mutual Insurance Company (the parent company of LIB) will hold a 30% and 70% equity stake respectively in LIB and AGIB. Under the deal, LIB will also acquire the remaining 49% in AGIB from Insurance Australia Group (IAG).

The combined entity is expected to become the largest motor insurer and the number two property and casualty insurer in the market with an estimated proforma premium base of RM2.3 billion in 2022 based on 2020 data.

As part of the transaction, the prospective merged entity will enter into an exclusive 20-year new bancassurance partnership with AMMB Group to distribute general insurance products. AGIB was founded in 2012 with the merger of AmG Insurance Bhd and Kurnia Insurance (M) Bhd in September 2012.

Upon completion of the proposed disposal, AMMB and Liberty Mutual Insurance Company (the parent company of LIB) will hold a 30% and 70% equity stake respectively in LIB and AGIB. Under the deal, LIB will also acquire the remaining 49% in AGIB from Insurance Australia Group (IAG).

The combined entity is expected to become the largest motor insurer and the number two property and casualty insurer in the market with an estimated proforma premium base of RM2.3 billion in 2022 based on 2020 data.

As part of the transaction, the prospective merged entity will enter into an exclusive 20-year new bancassurance partnership with AMMB Group to distribute general insurance products. AGIB was founded in 2012 with the merger of AmG Insurance Bhd and Kurnia Insurance (M) Bhd in September 2012.

Wednesday, July 21, 2021

Boss Versus Leader

Each day, John repeats his commands to his employees, and for the most part they obey. However, his employees don’t act on their own. John is the owner of his company, which also makes him the boss—a title bestowed upon him merely because of his ownership. But shop leader? That title is not automatically given to him. Until John realizes this, he will be forever stuck, where each day’s outcome depends on John’s decisions and commands—an exhausting way to manage a shop; where very little, if any, business progress is possible.

Most owners become very proficient in knowing how to run a business. But, knowing how to run a business and how to lead people are two very different things. Reaching a shop’s potential and long-term success requires a shop culture where employees are united by a common purpose.

Directing people is what bosses do - but dictating orders does not mean people understand why they are following them. If employees don’t understand the “why” they will only perform those tasks because they feel they have to. And if people don’t fully believe in what they are being asked to do, there is no reason for them to repeat those tasks on their own. Leaders get others to follow them because there is a common emotional connection between the individuals and management. How this is accomplished requires a different style of managing people. As shop owners learn to become leaders, they realize that it’s not only their perspective that matters, but also the perspective of the people around them. Leaders are more effective, create higher morale and reach greater success because the entire team has a shared purpose and will work in unity.

Let’s outline a few key steps to transform a boss to a leader.

First, it’s all about people. People are the foundation of a company’s success and owners need to create an environment where employees understand that their personal success is dependent on the success of the team. This requires a leader that creates a workplace based on respect and trust. Leaders also encourage employees to become more independent and make decisions on their own.

Second, help employees grow within your company. Allow people to become responsible for their future. This happens best when the leader is directly responsible for their growth through training, one on one reviews and team meetings. Equally important is praise and recognition for hard work, and accomplishments. Please understand that the people will make mistakes. It’s important that we use mishaps as a teaching tool. If you encourage and praise the right performance, people will be receptive to you when you bring up when they dropped the ball.

Third, understand what matters to others. This is a tough one. After all, the shop owner knows exactly what it takes to operate a business, and when things go wrong, it’s the job of the shop owner to make things right. You need to understand that your employees view the world from a different position. You may not always agree with their viewpoint, but to move forward and improve, you must listen and find common ground with employees.

Lastly, take the heat when things go wrong and give all the praise to others when things go right. There is no better way to gain respect from your employees than by understanding this fundamental principle. Leaders are no different than coaches. All great coaches blame themselves when they lose and give all the credit to the players when they win. This one strategy will do amazing things for your shop. This also creates the right mindset for you, and will push you to work on the important things when challenges do occur.

Become a true leader, and the outcome of each day will not be fully dependent on your decisions and commands, but will become a combined effort from your entire team. And wouldn’t it be great if that was what we repeated each and every day?

Most owners become very proficient in knowing how to run a business. But, knowing how to run a business and how to lead people are two very different things. Reaching a shop’s potential and long-term success requires a shop culture where employees are united by a common purpose.

Directing people is what bosses do - but dictating orders does not mean people understand why they are following them. If employees don’t understand the “why” they will only perform those tasks because they feel they have to. And if people don’t fully believe in what they are being asked to do, there is no reason for them to repeat those tasks on their own. Leaders get others to follow them because there is a common emotional connection between the individuals and management. How this is accomplished requires a different style of managing people. As shop owners learn to become leaders, they realize that it’s not only their perspective that matters, but also the perspective of the people around them. Leaders are more effective, create higher morale and reach greater success because the entire team has a shared purpose and will work in unity.

Let’s outline a few key steps to transform a boss to a leader.

First, it’s all about people. People are the foundation of a company’s success and owners need to create an environment where employees understand that their personal success is dependent on the success of the team. This requires a leader that creates a workplace based on respect and trust. Leaders also encourage employees to become more independent and make decisions on their own.

Second, help employees grow within your company. Allow people to become responsible for their future. This happens best when the leader is directly responsible for their growth through training, one on one reviews and team meetings. Equally important is praise and recognition for hard work, and accomplishments. Please understand that the people will make mistakes. It’s important that we use mishaps as a teaching tool. If you encourage and praise the right performance, people will be receptive to you when you bring up when they dropped the ball.

Third, understand what matters to others. This is a tough one. After all, the shop owner knows exactly what it takes to operate a business, and when things go wrong, it’s the job of the shop owner to make things right. You need to understand that your employees view the world from a different position. You may not always agree with their viewpoint, but to move forward and improve, you must listen and find common ground with employees.

Lastly, take the heat when things go wrong and give all the praise to others when things go right. There is no better way to gain respect from your employees than by understanding this fundamental principle. Leaders are no different than coaches. All great coaches blame themselves when they lose and give all the credit to the players when they win. This one strategy will do amazing things for your shop. This also creates the right mindset for you, and will push you to work on the important things when challenges do occur.

Become a true leader, and the outcome of each day will not be fully dependent on your decisions and commands, but will become a combined effort from your entire team. And wouldn’t it be great if that was what we repeated each and every day?

Toxic Boss A Bomb In Office

Toxic boss is more dangerous than bomb about to blow-up in the office. Not only do they infect the workplace, but they create a culture where people are afraid to speak up or ask for help. Over time, this toxicity destroys employee confidence, negatively impacts their job and causes their mental health to deteriorate. As a result, employees rely on their savings to salvage their mental health until they’re able to put in their resignation notice.

Leader with low emotional intelligence (EQ) exhibits negative behavior

- Two-thirds of employees said their performance declined

- 12% of employees resigned due to the low EQ behavior

- More than 75% of employees said their loyalty to their employer waned

- Four out of five employees lost work time worrying about an unpleasant incident that

A Harvard Business School - discovered that toxic bosses resulted in

- 25% of employees taking their frustrations out on clients and customers

- 48% intentionally decreased their work effort and intentionally spent less time at work

- 78% said their commitment to their organization declined

- 66% said their performance declined

It’s no surprise that more than 57% of employees quit because of a bad boss. While many companies are being exposed for their toxic workplaces and CEOs, even more are still suffering in silence.

Some reasons why employees end up staying in a toxic workplace are

- 25% of employees taking their frustrations out on clients and customers

- 48% intentionally decreased their work effort and intentionally spent less time at work

- 78% said their commitment to their organization declined

- 66% said their performance declined

It’s no surprise that more than 57% of employees quit because of a bad boss. While many companies are being exposed for their toxic workplaces and CEOs, even more are still suffering in silence.

Some reasons why employees end up staying in a toxic workplace are

- The benefits and salary are better

- They feel obligated to stick it out so their resume doesn’t look bad

- They love the work they do

- They lack the confidence and belief that they can get a better job

- The company is currently paying for a program or tuition requiring them to stay

Spotting Toxic boss

1: Unrealistic Expectations With Impossible Deadlines - Constantly feeling overworked and unsure of your boss’s expectations is a clear sign that your boss is a toxic. Rather than being respectful of your time, toxic boss expects you to drop everything to complete a project with an impossible turnaround time. When you try to speak up, they refuse to listen or take it as you not understanding the urgency of the issue. However, it’s not that the urgency isn’t understood, it’s that the deadline is impossible and the team is set up for failure. As such, employees are forced to produce less than quality work and abandon processes to complete the task that they’re then reprimanded for later. Likewise, toxic bosses don’t commit to expectations. Even when they do, they’re always changing details. Employees quickly become burnt out because they’re always trying to anticipate what’s new, what’s changed and what their boss expects.

2: Using Their Authority To Dictate But Not Hold Themselves Accountable - Toxic bosses are infamous for using their authority to bypass rules and processes. They believe that their role in the company makes them infallible. Rather than admit a mistake or take responsibility for something that went wrong, they ignore it, place blame or make excuses. When evidence or constructive feedback is provided, they take it as an attack and often seek retaliation for being challenged. Retaliation can come in the form of preventing one’s hire, excluding them from meetings or rejecting one’s idea, to name a few. It’s this reason that those around the toxic boss or manager often turn into enablers who never say no to them for fear of what they might lose if they do. The most evident personality trait of a toxic leader is when they don’t practice what they preach. Employees are “inspired by leaders who live and breathe the example they want to be followed. However, toxic bosses don’t value the well-being of their employees because they’re too worried about themselves.

3: Low Emotional Intelligence And Reactive Decision Making - Toxic bosses can negatively impact a company in more ways than one. Not only do they drive their own employees away, but they also drive their clients and customers away. As a result, they develop a poor reputation in their industry due to their toxic behaviors and reactionary decision-making. Yet, they fail to see how their decisions, words and behaviors negatively impact others.

- They feel obligated to stick it out so their resume doesn’t look bad

- They love the work they do

- They lack the confidence and belief that they can get a better job

- The company is currently paying for a program or tuition requiring them to stay

Spotting Toxic boss

1: Unrealistic Expectations With Impossible Deadlines - Constantly feeling overworked and unsure of your boss’s expectations is a clear sign that your boss is a toxic. Rather than being respectful of your time, toxic boss expects you to drop everything to complete a project with an impossible turnaround time. When you try to speak up, they refuse to listen or take it as you not understanding the urgency of the issue. However, it’s not that the urgency isn’t understood, it’s that the deadline is impossible and the team is set up for failure. As such, employees are forced to produce less than quality work and abandon processes to complete the task that they’re then reprimanded for later. Likewise, toxic bosses don’t commit to expectations. Even when they do, they’re always changing details. Employees quickly become burnt out because they’re always trying to anticipate what’s new, what’s changed and what their boss expects.

2: Using Their Authority To Dictate But Not Hold Themselves Accountable - Toxic bosses are infamous for using their authority to bypass rules and processes. They believe that their role in the company makes them infallible. Rather than admit a mistake or take responsibility for something that went wrong, they ignore it, place blame or make excuses. When evidence or constructive feedback is provided, they take it as an attack and often seek retaliation for being challenged. Retaliation can come in the form of preventing one’s hire, excluding them from meetings or rejecting one’s idea, to name a few. It’s this reason that those around the toxic boss or manager often turn into enablers who never say no to them for fear of what they might lose if they do. The most evident personality trait of a toxic leader is when they don’t practice what they preach. Employees are “inspired by leaders who live and breathe the example they want to be followed. However, toxic bosses don’t value the well-being of their employees because they’re too worried about themselves.

3: Low Emotional Intelligence And Reactive Decision Making - Toxic bosses can negatively impact a company in more ways than one. Not only do they drive their own employees away, but they also drive their clients and customers away. As a result, they develop a poor reputation in their industry due to their toxic behaviors and reactionary decision-making. Yet, they fail to see how their decisions, words and behaviors negatively impact others.

Leader with low emotional intelligence (EQ) exhibits negative behavior

- Two-thirds of employees said their performance declined

- 12% of employees resigned due to the low EQ behavior

- More than 75% of employees said their loyalty to their employer waned

- Four out of five employees lost work time worrying about an unpleasant incident that

occurred

- 63% of employees wasted work time trying to avoid the offender at all costs

Reactive decision making creates a chaotic and stressful work environment that leads to increased employee burnout. Often times, bosses who are reactive can turn trivial things into full-blown crises. They hyperfocus on things to the point where they immerse themselves into other people’s roles because they don’t trust that their employees are working fast enough. Not only is this demotivating to employees, but it devalues their expertise and position in the company.

The unfortunate reality is that most toxic bosses only see their workers as profit producers rather than humans. Thus, they create a culture of disposable workers which is undoubtedly felt by the employees. As such, their loyalty and commitment to the company to rapidly deteriorate. Companies with toxic workplaces may be able to hire top talent, but the reality is, they’ll struggle to retain them. No amount of money, future promises or job title is worth the mental health impact of a toxic boss.

- 63% of employees wasted work time trying to avoid the offender at all costs

Reactive decision making creates a chaotic and stressful work environment that leads to increased employee burnout. Often times, bosses who are reactive can turn trivial things into full-blown crises. They hyperfocus on things to the point where they immerse themselves into other people’s roles because they don’t trust that their employees are working fast enough. Not only is this demotivating to employees, but it devalues their expertise and position in the company.

The unfortunate reality is that most toxic bosses only see their workers as profit producers rather than humans. Thus, they create a culture of disposable workers which is undoubtedly felt by the employees. As such, their loyalty and commitment to the company to rapidly deteriorate. Companies with toxic workplaces may be able to hire top talent, but the reality is, they’ll struggle to retain them. No amount of money, future promises or job title is worth the mental health impact of a toxic boss.

Monday, July 19, 2021

SOCSO Covers Gig Workers

More than 145,000 gig workers will be covered by SOCSO include food delivery riders, walkers, and also parcel delivery partners. Foodpanda and Grab have become the first among the 133 service providers in the country to enroll their delivery partners under its Occupational Disaster Scheme.

The SPS Lindung scheme is paid by the government for a year. To ensure that these gig workers are protected and in order to encourage more of them to register, the government will provide assistance in the form of full funding under Plan Two of the Self Employment Social Security Scheme (SKSPS) which is RM232.80 for the coverage period for a year.

Benefits include medical, temporary disablement, permanent disablement, dependents and funeral benefits, constant care allowance, education benefit, and facilities for physical or vocational rehabilitation. dung scheme is paid by the government for a year

To ensure that these gig workers are protected and in order to encourage more of them to register, the government will provide assistance in the form of full funding under Plan Two of the Self Employment Social Security Scheme (SKSPS) which is RM232.80 for the coverage period for a year.

SOCSO, however, stated that as of 9 July the number of delivery partners who have registered and are actively contributing is still low. A total of 64,773 delivery partners have registered and are actively contributing under SKSPS. They make up about 39% of the 166,189 total gig workers in the country contributing to SOCSO.

There are 2.72 million gig workers recorded by the Department of Statistics Malaysia, the number of gig workers contributing to SOCSO is still low at only 6.1%.

The SPS Lindung scheme is paid by the government for a year. To ensure that these gig workers are protected and in order to encourage more of them to register, the government will provide assistance in the form of full funding under Plan Two of the Self Employment Social Security Scheme (SKSPS) which is RM232.80 for the coverage period for a year.

Benefits include medical, temporary disablement, permanent disablement, dependents and funeral benefits, constant care allowance, education benefit, and facilities for physical or vocational rehabilitation. dung scheme is paid by the government for a year

To ensure that these gig workers are protected and in order to encourage more of them to register, the government will provide assistance in the form of full funding under Plan Two of the Self Employment Social Security Scheme (SKSPS) which is RM232.80 for the coverage period for a year.

SOCSO, however, stated that as of 9 July the number of delivery partners who have registered and are actively contributing is still low. A total of 64,773 delivery partners have registered and are actively contributing under SKSPS. They make up about 39% of the 166,189 total gig workers in the country contributing to SOCSO.

There are 2.72 million gig workers recorded by the Department of Statistics Malaysia, the number of gig workers contributing to SOCSO is still low at only 6.1%.

Saturday, July 10, 2021

AirAsia Gojek Partnership

AirAsia's deal with Gojek is poised to take over the latter’s Thailand business has gone through. The share deal is worth US$50 million (RM208.8 million), and it will allow AirAsia to expand into ride-hailing, delivery and fintech services in the kingdom without building from scratch.

The share deal will see Gojek receive 4.76% of shares in AirAsia’s SuperApp, one of three key digital businesses of AirAsia Digital, the umbrella for the low-cost carrier’s non aviation ventures. With the disposal of its Thai operations, the Indonesian unicorn will focus on expansion in Vietnam and Singapore.

The share deal will see Gojek receive 4.76% of shares in AirAsia’s SuperApp, one of three key digital businesses of AirAsia Digital, the umbrella for the low-cost carrier’s non aviation ventures. With the disposal of its Thai operations, the Indonesian unicorn will focus on expansion in Vietnam and Singapore.

AirAsia views this move as the right opportunity to leverage know-how from Gojek and integrate it with the much stronger brand of AirAsia and expand into food deliveries and fintech services.

The rebranding from Gojek’s GoFood to AirAsia Food will happen early next month. AirAsia have also secured a license to operate fintech services in Thailand via GoPay, another ambitious expansion we are eyeing in the country. The BigPay brand will be used once required licenses from the Bank of Thailand have been obtained, and the target is the first quarter of 2022.

AirAsia aims to steer the business towards profitability within one year via expansion beyond Bangkok, starting with three key provinces in the fourth quarter. Phuket, Chiang Mai and Hat Yai are three locations where AirAsia has a presence. Strong brand awareness aside, AirAsia also has the advantage of a large customer database from selling plane tickets for 17 years.

In the food delivery business, GrabFood is the market leader with 50% of Thailand’s US$2.8 billion (RM11.64 billion) market in 2020. Behind Grab is Foodpanda and Line with 23% and 20% share respectively. Gojek’s GoFood had a 7% share of the Thai market. Besides AirAsia, e-commerce giant Shopee is reported to be interested in moving into food delivery in the Land of Smiles.

The rebranding from Gojek’s GoFood to AirAsia Food will happen early next month. AirAsia have also secured a license to operate fintech services in Thailand via GoPay, another ambitious expansion we are eyeing in the country. The BigPay brand will be used once required licenses from the Bank of Thailand have been obtained, and the target is the first quarter of 2022.

AirAsia aims to steer the business towards profitability within one year via expansion beyond Bangkok, starting with three key provinces in the fourth quarter. Phuket, Chiang Mai and Hat Yai are three locations where AirAsia has a presence. Strong brand awareness aside, AirAsia also has the advantage of a large customer database from selling plane tickets for 17 years.

In the food delivery business, GrabFood is the market leader with 50% of Thailand’s US$2.8 billion (RM11.64 billion) market in 2020. Behind Grab is Foodpanda and Line with 23% and 20% share respectively. Gojek’s GoFood had a 7% share of the Thai market. Besides AirAsia, e-commerce giant Shopee is reported to be interested in moving into food delivery in the Land of Smiles.

Insurance Agent Cheated Friend

An insurance agent in Singapore admitted to cheating his primary school friend of SG$24,900 by issuing a fake insurance policy. Sng Kang Xiang, 37, pleaded guilty to one count of forgery and one count of cheating, with two similar charges to be taken into consideration for sentencing.

The accused had worked as a financial services consultant and insurance agent for AIA Singapore for around 11 years before the fraud occurred in 2018. Sng, who knew the victim since primary school, contacted her in March 2018 and told her about an insurance policy that was available for “absolute assignment”, where the policy would be bought from an existing policyholder.

The court heard that the victim had a “trusted relationship” with Sng, having bought several insurance policies from Sng, including policies for her mother. The victim paid SG$24,900 to Sng by transferring it to his bank account, after being told that she would get back the amount after a year, plus an additional SG$5,293. However, no such policy existed.

The victim said that for the previous policies she bought from Sng, she also transferred the money to his account. This was contrary to AIA’s policy that premium payments should be directly transferred to them and not to an agent’s personal bank accounts, investigations revealed.

Sng allegedly used the money to pay off credit card debt and renovate his flat. When pressed by the victim on the lack of any official policy documents, Sng sent her a forged letter with AIA’s letterhead, stating that the company had received her payment. However, the victim got suspicious and confirmed separately with AIA, causing the fraud to come to light.

AIA has compensated the victim for her losses, and Sng has made full restitution to the insurance company. He will return to court in July for mitigation and sentencing. Each charge of cheating and forgery carries a sentence of up to 10 years’ imprisonment plus a fine.

The accused had worked as a financial services consultant and insurance agent for AIA Singapore for around 11 years before the fraud occurred in 2018. Sng, who knew the victim since primary school, contacted her in March 2018 and told her about an insurance policy that was available for “absolute assignment”, where the policy would be bought from an existing policyholder.

The court heard that the victim had a “trusted relationship” with Sng, having bought several insurance policies from Sng, including policies for her mother. The victim paid SG$24,900 to Sng by transferring it to his bank account, after being told that she would get back the amount after a year, plus an additional SG$5,293. However, no such policy existed.

The victim said that for the previous policies she bought from Sng, she also transferred the money to his account. This was contrary to AIA’s policy that premium payments should be directly transferred to them and not to an agent’s personal bank accounts, investigations revealed.

Sng allegedly used the money to pay off credit card debt and renovate his flat. When pressed by the victim on the lack of any official policy documents, Sng sent her a forged letter with AIA’s letterhead, stating that the company had received her payment. However, the victim got suspicious and confirmed separately with AIA, causing the fraud to come to light.

AIA has compensated the victim for her losses, and Sng has made full restitution to the insurance company. He will return to court in July for mitigation and sentencing. Each charge of cheating and forgery carries a sentence of up to 10 years’ imprisonment plus a fine.

Covid19 Fraud Claim Increases - Thailand

Claims lodged on popular COVID-19 insurance policies in Thailand have grown tenfold since last year, prompting the insurance authorities to launch investigations into possible fraud. The Office of Insurance Commission (OIC), the country's insurance regulator, has warned on its website it is investigating possible insurance fraud after seeing COVID claims soar.

As of end-April 2020, when Thailand began witnessing a third wave of the pandemic, the number of COVID-19 policyholders stood at 13.8m with total premiums of THB5.9bn ($184m), according to the OIC. COVID-19 claims for the month jumped to THB1.7bn from THB170m the previous year.

Deliberately becoming infected - Analysts attributed the rise in COVID-19 claims to the pandemic-battered Thai economy, which has seen people hit so hard that they deliberately risk infection to receive insurance payouts. With suspicious claims rising, some major non-life insurance companies have stopped selling COVID-19 policies.

The Thai General Insurance Association — which comprises all 56 non-life insurance companies in Thailand — is warning people against deliberately becoming infected with COVID-19 in order to claim compensation because they may face fraud charges.

When COVID first struck Thailand last year, several insurers started to offer non-life COVID-19 insurance policies. Customers could buy coverage ranging from THB100,000 to THB300,000 for about THB500 a year.

As of end-April 2020, when Thailand began witnessing a third wave of the pandemic, the number of COVID-19 policyholders stood at 13.8m with total premiums of THB5.9bn ($184m), according to the OIC. COVID-19 claims for the month jumped to THB1.7bn from THB170m the previous year.

Deliberately becoming infected - Analysts attributed the rise in COVID-19 claims to the pandemic-battered Thai economy, which has seen people hit so hard that they deliberately risk infection to receive insurance payouts. With suspicious claims rising, some major non-life insurance companies have stopped selling COVID-19 policies.

The Thai General Insurance Association — which comprises all 56 non-life insurance companies in Thailand — is warning people against deliberately becoming infected with COVID-19 in order to claim compensation because they may face fraud charges.

When COVID first struck Thailand last year, several insurers started to offer non-life COVID-19 insurance policies. Customers could buy coverage ranging from THB100,000 to THB300,000 for about THB500 a year.

Friday, July 9, 2021

Pelindungan Tenang - MicroInsurance Malaysia

Central Bank of Malaysia (Bank Negara Malaysia) issued the policy document on Perlindungan Tenang on 2 July 2021. The Policy Document, which took effect on 5 July 2021, applies to licensed insurers under the Financial Services Act 2013 and licensed takaful operators under the Islamic Financial Services Act 2013 (individually a ‘licensed person’ and collectively ‘licensed persons’).

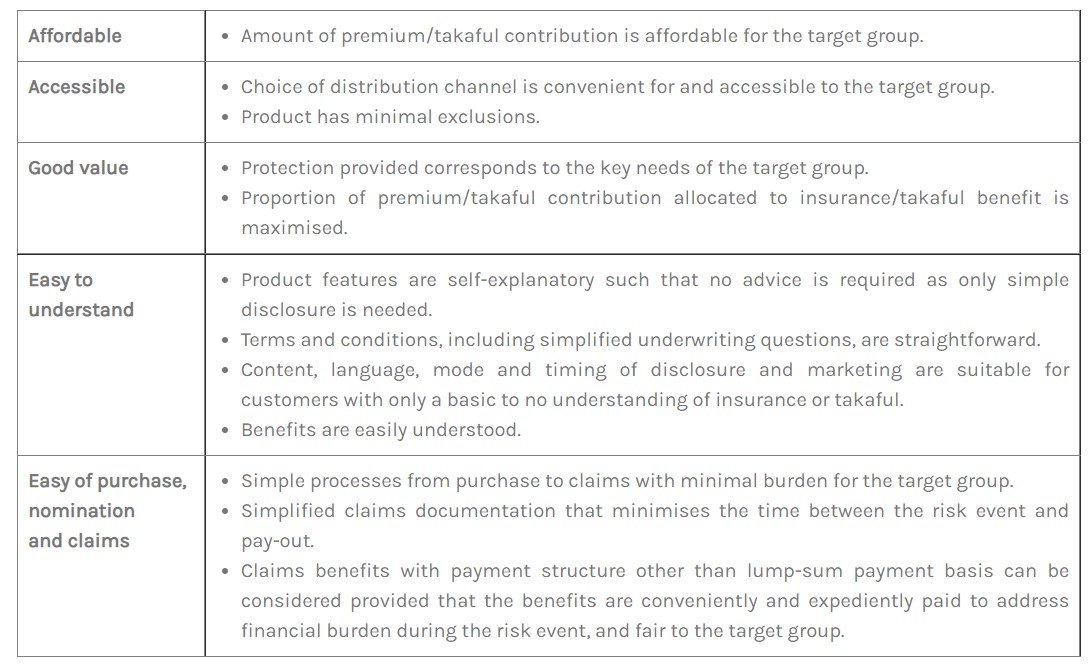

Perlindungan Tenang is an initiative launched by BNM in 2017 in collaboration with the insurance and takaful industry to provide microinsurance/microtakaful products (being life and general insurance and takaful products) to the unserved and underserved segments, in particular the households belonging to the bottom 40% of the income groups in Malaysia (B40), which are affordable, accessible, provide good protection value and are easy to understand, simple to purchase and to make claims.

The Policy Document seeks to provide a more enabling and fit-for-purpose regulatory framework since the launch of the Perlindungan Tenang initiative in 2017 and focuses on the following areas:

Licensed persons are required to meet the following requirements for Perlindungan Tenang products:

The requirements and matters to be considered in relation to the structuring and offering of combined products are set out in section 9 of the Policy Document.

All Perlindungan Tenang products (including combined products) require BNM’s approval before they are launched.

A new category of intermediaries, ‘Perlindungan Tenang partner’ (‘PT Partner’), is introduced to broaden the distribution channels for Perlindungan Tenang products. This new category is in addition to the existing intermediaries. A PT Partner must be:

There is no limit to the number of licensed persons a PT Partner may represent.

Detailed requirements relating to a PT Partner are set out in sections 10 and 11 of the Policy Document.d underserved segments of Malaysian society.

Perlindungan Tenang is an initiative launched by BNM in 2017 in collaboration with the insurance and takaful industry to provide microinsurance/microtakaful products (being life and general insurance and takaful products) to the unserved and underserved segments, in particular the households belonging to the bottom 40% of the income groups in Malaysia (B40), which are affordable, accessible, provide good protection value and are easy to understand, simple to purchase and to make claims.

The Policy Document seeks to provide a more enabling and fit-for-purpose regulatory framework since the launch of the Perlindungan Tenang initiative in 2017 and focuses on the following areas:

- Empower licensed persons to offer more innovative, diverse and meaningful microinsurance and microtakaful products in a sustainable manner through clearer expectations on product development

- Promote a wider take-up of microinsurance and microtakaful products by broadening the distribution channels to address challenges associated with high distribution costs, as well as enabling product combination; and

- Strengthen consumer protection requirements to safeguard consumer interests.

|

Licensed persons are required to meet the following requirements for Perlindungan Tenang products:

- minimum 15 days free look period and 30 days grace period for policies or takaful certificates with term coverage of at least one year

- allows guaranteed acceptance or on-the-spot acceptance or rejection of risk

- without savings or investment feature, or surrender benefits; and

- claims to be paid out within five working days (for death claims) and seven working days (for non-death claims) from the receipt of a claim notification.

The requirements and matters to be considered in relation to the structuring and offering of combined products are set out in section 9 of the Policy Document.

All Perlindungan Tenang products (including combined products) require BNM’s approval before they are launched.

A new category of intermediaries, ‘Perlindungan Tenang partner’ (‘PT Partner’), is introduced to broaden the distribution channels for Perlindungan Tenang products. This new category is in addition to the existing intermediaries. A PT Partner must be:

- a sole proprietorship, partnership or company;

- an agent bank; or

- a society, including co-operatives or non-governmental organisation.

There is no limit to the number of licensed persons a PT Partner may represent.

Detailed requirements relating to a PT Partner are set out in sections 10 and 11 of the Policy Document.d underserved segments of Malaysian society.

Universal Life Policy

Life insurance should be part of your overall financial plan regardless of your marital status. It provides financial support to you and your family if you are disable or pass away and gives you peace of mind that your loved ones will be cared for.

Universal life insurance is often sold as a combination of life insurance and an investment product. Similar to whole life insurance, universal life insurance lasts for your entire life (as long as you pay your premiums) and provides a standard death benefit coverage as well as a cash value that grows over time.

While it may sound tempting to have a life insurance policy you can tap into for cash while you’re still alive, it comes at a hefty cost — universal life insurance is much more expensive than term life insurance, which provides the same death benefit minus the savings vehicle.

What Is Universal Life Insurance - is a type of permanent life insurance policy that combines a death benefit with a savings vehicle. With this type of policy, you’re guaranteed coverage for your entire life as long as you pay your monthly premiums. This policy builds up a cash value that you can borrow from or withdraw later. Compared to whole life insurance, universal life insurance offers greater flexibility since it offers adjustable premiums and an adjustable death benefit.

In general, it is not recommended to treat life insurance as an investment. The basic concept of insurance is to protect yourself financially if an unlikely but expensive bad thing happens — or in this case, protecting your loved ones who depend on your income in the case of your death.”

How Does Universal Life Insurance Work - Universal life insurance has two components: death benefit coverage and an accumulating cash value. When you pay your monthly premium, it’s split between the two parts of your policy, with a portion going to each. One component of the universal life insurance provides a death benefit to your beneficiaries when you die. Some universal life insurance policies offer a flexible death benefit, meaning your insurer may allow you to increase your death benefit — which will in turn increase your premiums (provided you take another medical exam). Typically, the death benefit component of life insurance is the most important part, since it gives your loved ones a financial safety net if you die and can no longer provide for them.

The additional feature universal life insurance has that term life insurance doesn’t is a cash value that earns interest over time based on the current money market rates. As the cash value increases, you can use it to pay your premiums, borrow against it, or withdraw it altogether. However, if you’re looking to grow your money, there are better options available. Typically the rate of investment accumulation inside a life insurance policy versus other options available to you out there, it is very slow.

Universal vs. Whole Life Insurance - whole life insurance is a type of permanent life insurance policy that covers you for your entire life. Like universal life insurance, this type of policy combines the death benefit associated with term life policies with an additional savings component.

Unlike universal life insurance, whole life policies have fixed monthly premiums, with a certain portion going toward your death benefit and the rest going toward your accumulated cash value. Whole life insurance policies often have more expensive premiums than universal life, although both are significantly more expensive than term life insurance.

A universal life plan has an adjustable cash value, and the premium can be adjustable. This means that if you lose some income in any given month, you have the option of making only your minimum payments and not the full amount. On the other hand, if you have some extra cash, you can put it towards your insurance premiums. Compared to whole life insurance, this feature of universal life insurance offers greater flexibility.

Who Qualifies for Universal Life Insurance - In general, you’re likely to qualify for universal life coverage unless extenuating circumstances cause your application to be denied. Factors that could cause you to be denied include:

Universal life insurance is often sold as a combination of life insurance and an investment product. Similar to whole life insurance, universal life insurance lasts for your entire life (as long as you pay your premiums) and provides a standard death benefit coverage as well as a cash value that grows over time.

While it may sound tempting to have a life insurance policy you can tap into for cash while you’re still alive, it comes at a hefty cost — universal life insurance is much more expensive than term life insurance, which provides the same death benefit minus the savings vehicle.

What Is Universal Life Insurance - is a type of permanent life insurance policy that combines a death benefit with a savings vehicle. With this type of policy, you’re guaranteed coverage for your entire life as long as you pay your monthly premiums. This policy builds up a cash value that you can borrow from or withdraw later. Compared to whole life insurance, universal life insurance offers greater flexibility since it offers adjustable premiums and an adjustable death benefit.

In general, it is not recommended to treat life insurance as an investment. The basic concept of insurance is to protect yourself financially if an unlikely but expensive bad thing happens — or in this case, protecting your loved ones who depend on your income in the case of your death.”

How Does Universal Life Insurance Work - Universal life insurance has two components: death benefit coverage and an accumulating cash value. When you pay your monthly premium, it’s split between the two parts of your policy, with a portion going to each. One component of the universal life insurance provides a death benefit to your beneficiaries when you die. Some universal life insurance policies offer a flexible death benefit, meaning your insurer may allow you to increase your death benefit — which will in turn increase your premiums (provided you take another medical exam). Typically, the death benefit component of life insurance is the most important part, since it gives your loved ones a financial safety net if you die and can no longer provide for them.

The additional feature universal life insurance has that term life insurance doesn’t is a cash value that earns interest over time based on the current money market rates. As the cash value increases, you can use it to pay your premiums, borrow against it, or withdraw it altogether. However, if you’re looking to grow your money, there are better options available. Typically the rate of investment accumulation inside a life insurance policy versus other options available to you out there, it is very slow.

Universal vs. Whole Life Insurance - whole life insurance is a type of permanent life insurance policy that covers you for your entire life. Like universal life insurance, this type of policy combines the death benefit associated with term life policies with an additional savings component.

Unlike universal life insurance, whole life policies have fixed monthly premiums, with a certain portion going toward your death benefit and the rest going toward your accumulated cash value. Whole life insurance policies often have more expensive premiums than universal life, although both are significantly more expensive than term life insurance.

A universal life plan has an adjustable cash value, and the premium can be adjustable. This means that if you lose some income in any given month, you have the option of making only your minimum payments and not the full amount. On the other hand, if you have some extra cash, you can put it towards your insurance premiums. Compared to whole life insurance, this feature of universal life insurance offers greater flexibility.

Who Qualifies for Universal Life Insurance - In general, you’re likely to qualify for universal life coverage unless extenuating circumstances cause your application to be denied. Factors that could cause you to be denied include:

- Poor physical health: Insurance companies may decline to provide coverage for individuals with serious health conditions

- Age: Most insurance companies will only provide life insurance coverage for individuals under a certain age

- Lifestyle: Insurance companies may be more likely to deny coverage to individuals with high-risk hobbies, a high-risk job, or unhealthy habits.

- Credit: Insurance companies often run credit checks before underwriting insurance policies. If you have poor credit or a poor financial history, you may struggle to qualify for a policy

- Criminal record: You may be denied life insurance coverage if you have a criminal record, especially if you have felonies on your record.

Wednesday, July 7, 2021

Vietnam Tiki Partner With AIA

Vietnam's Tiki will add AIA insurance to its e-commerce site's offerings, marking a further push into financial services aimed at grabbing market share from bigger rivals Shopee and Lazada.

Vietnamese customers will be able to buy health and life insurance first, part of a long-term strategy to meet more of online shoppers' "financial needs". The startup said it will personalize services for individual customers, such as recommending particular insurance packages, and will expand into other financial products like savings plans.

The announcement comes as startups across Southeast Asia continue to branch out into financial technology to build customer loyalty, as seen in the digital bank licenses obtained by Grab in Singapore and a GoTo affiliate in Indonesia.

In Tiki's case, experts say insurance sales will rise if the company can apply its technological advantage and analyze Vietnamese shopper demographics accurately. Tiki has a huge database of users, and they know who is spending on which products.

Tiki, which also issues a credit card through Sacombank, is the biggest local online retailer in Vietnam. However, it trails Sea's Shopee, which leads among web and iPhone-based shoppers, and Alibaba's Lazada, which has the most Android app downloads. Reports that Tiki would merge with Sen Do to form a larger Vietnamese challenger have yet to materialize.

The two companies struck a 10-year deal meant to expand into other businesses in the internet economy, such as digital health services. Tiki's investors include China's JD.com and Vietnamese unicorn VNG.

Vietnamese customers will be able to buy health and life insurance first, part of a long-term strategy to meet more of online shoppers' "financial needs". The startup said it will personalize services for individual customers, such as recommending particular insurance packages, and will expand into other financial products like savings plans.

The announcement comes as startups across Southeast Asia continue to branch out into financial technology to build customer loyalty, as seen in the digital bank licenses obtained by Grab in Singapore and a GoTo affiliate in Indonesia.

In Tiki's case, experts say insurance sales will rise if the company can apply its technological advantage and analyze Vietnamese shopper demographics accurately. Tiki has a huge database of users, and they know who is spending on which products.

Tiki, which also issues a credit card through Sacombank, is the biggest local online retailer in Vietnam. However, it trails Sea's Shopee, which leads among web and iPhone-based shoppers, and Alibaba's Lazada, which has the most Android app downloads. Reports that Tiki would merge with Sen Do to form a larger Vietnamese challenger have yet to materialize.

The two companies struck a 10-year deal meant to expand into other businesses in the internet economy, such as digital health services. Tiki's investors include China's JD.com and Vietnamese unicorn VNG.

Nominee In Life Insurance

When an insured person dies, his/her nominee becomes the receiver of the claim amount? Nominee cannot use that money by himself unless he is a legal heir. However, suppose an policyholder has appointed a beneficial nominee while purchasing insurance, he/she becomes the end consumer of the claim amount.

It is essential to appoint a nominee for all your assets, investments and insurance policies. This practice ensures that the proceeds go to the rightful beneficiary. If the nominee is a minor, the insured may appoint or designate a person to receive the money on the nominee’s behalf if the insured person dies. Generally, children below 18 years of age are not considered eligible to handle claim amounts. Hence, the insured needs to assign an appointee or custodian. So, if any claim arises, the claim amount is paid to the appointee for custody till the minor turns a major.

Beneficial nominee: Nomination has been made mandatory while purchasing life insurance. Nominees such as parents, spouses and children are now considered beneficial nominees, while previously, they were mere receivers. When an insured mentions any beneficial nominee in the proposal form, the claim proceeds get undisputedly shared with them.

An insured may nominate a person who is entitled to receive the death proceeds in a life insurance policy. However, the nominee may not have the right to use the proceeds, and is only a caretaker of the money on behalf of the legal heirs of the insured. If the insured declared his parents, spouse and children as nominees, they will be considered as beneficial nominees and will be beneficially entitled to the death proceeds of the life insurance policy.

Hence, it is essential that only immediate family members are appointed as beneficial nominees. If an insured names any one of them as nominees in a policy, they automatically become beneficial owners of the claim benefits. This simply means they are the final, undisputed beneficiaries.

You must also know that if the insured has not granted such a beneficial title to the nominee regarding the nature of his title, then the said nominations (spouse, children or parents) will not be considered a beneficial nominee.

The new clause also gives the insured the option of naming multiple nominees and specifying their exact share in the policy. Previously, life insurance firms would provide claim proceeds to the nominee, from whom the rightful legal heir could claim the benefits. The insurer now pays policy benefits only to beneficial nominees. Thus, it is prudent to understand the significance of life insurance “beneficial nominees" and declare one to avoid conflict.

Changing nominees: You must understand that the nomination process has to be up-to-date and in sync with whom the insured person wants to appoint as the beneficiary. It can be revoked or changed as many times as the insured may want to, but the last nominee supersedes all previous ones. The changes can be done any time during the policy term by making an endorsement.

An insurance endorsement is an amendment or addition to an existing insurance policy that changes certain terms of the original policy. It can be done at the time of the policy purchase, mid-term or at the time of renewal.

This way, you should always ensure that you have the right person as your beneficial nominee. This will help avoid disputes in the future and ensure that the claim amount is paid only to those you nominated as beneficiaries.

Beneficial nominee: Nomination has been made mandatory while purchasing life insurance. Nominees such as parents, spouses and children are now considered beneficial nominees, while previously, they were mere receivers. When an insured mentions any beneficial nominee in the proposal form, the claim proceeds get undisputedly shared with them.

An insured may nominate a person who is entitled to receive the death proceeds in a life insurance policy. However, the nominee may not have the right to use the proceeds, and is only a caretaker of the money on behalf of the legal heirs of the insured. If the insured declared his parents, spouse and children as nominees, they will be considered as beneficial nominees and will be beneficially entitled to the death proceeds of the life insurance policy.

Hence, it is essential that only immediate family members are appointed as beneficial nominees. If an insured names any one of them as nominees in a policy, they automatically become beneficial owners of the claim benefits. This simply means they are the final, undisputed beneficiaries.

You must also know that if the insured has not granted such a beneficial title to the nominee regarding the nature of his title, then the said nominations (spouse, children or parents) will not be considered a beneficial nominee.

The new clause also gives the insured the option of naming multiple nominees and specifying their exact share in the policy. Previously, life insurance firms would provide claim proceeds to the nominee, from whom the rightful legal heir could claim the benefits. The insurer now pays policy benefits only to beneficial nominees. Thus, it is prudent to understand the significance of life insurance “beneficial nominees" and declare one to avoid conflict.

Changing nominees: You must understand that the nomination process has to be up-to-date and in sync with whom the insured person wants to appoint as the beneficiary. It can be revoked or changed as many times as the insured may want to, but the last nominee supersedes all previous ones. The changes can be done any time during the policy term by making an endorsement.

An insurance endorsement is an amendment or addition to an existing insurance policy that changes certain terms of the original policy. It can be done at the time of the policy purchase, mid-term or at the time of renewal.

This way, you should always ensure that you have the right person as your beneficial nominee. This will help avoid disputes in the future and ensure that the claim amount is paid only to those you nominated as beneficiaries.

Friday, July 2, 2021

Insurer Bottom Of Food Chain

The Indonesian insurance industry will continue to stagnate, if it still has low bargaining power when dealing with other financial entities, especially banks and financing institutions, according to state-owned insurer Jasa Raharja. The picture now is that insurance currently places at the lowest level in the food chain.

Other financial institutions, like banks, transfer risk to the insurance sector but on terms and conditions that sometimes do not benefit the insurance company. The transfer of risk is also unequal, for example, when setting the criteria for what constitutes bad credit and determining claims to be paid out on such credit. Banks and insurance clearly need each other. But because insurers' bargaining position is weak, some of them tend to bend to the will of banks.

The situation is exacerbated by some insurance companies that are more “obedient” because their key performance is still focused on premium income or volume rather than the quality of business. This also has an impact on the increasing number of individuals who carry out business activities recklessly.

The weak bargaining position of insurers might be improved with the implementation of Financial Accounting Standard PSAK 74 which is based on the International Financial Accounting Standard (IFRS) 17. Insurers will no longer chase premiums alone because a portion of the premiums would not be categorized as income. The focus will be shifted to underwriting.

Other financial institutions, like banks, transfer risk to the insurance sector but on terms and conditions that sometimes do not benefit the insurance company. The transfer of risk is also unequal, for example, when setting the criteria for what constitutes bad credit and determining claims to be paid out on such credit. Banks and insurance clearly need each other. But because insurers' bargaining position is weak, some of them tend to bend to the will of banks.

The situation is exacerbated by some insurance companies that are more “obedient” because their key performance is still focused on premium income or volume rather than the quality of business. This also has an impact on the increasing number of individuals who carry out business activities recklessly.

The weak bargaining position of insurers might be improved with the implementation of Financial Accounting Standard PSAK 74 which is based on the International Financial Accounting Standard (IFRS) 17. Insurers will no longer chase premiums alone because a portion of the premiums would not be categorized as income. The focus will be shifted to underwriting.

Micro Entrepreneur & Informal Business Operator Insurance

The Ministry of Entrepreneur Development and Cooperatives (Medac) is planning to introduce an insurance scheme for micro entrepreneurs and informal business operators in the B40 group nationwide. This insurance scheme would be implemented following concerns that most entrepreneurs do not have any protection or insurance to fall back on during challenging times like the Covid-19 pandemic.

This scheme is expected to benefit nearly 2.5 million micro and informal entrepreneurs nationwide, including 900,000 entrepreneurs who are registered with the ministry and related agencies.

In another development, Medac's recommendation to include micro entrepreneurs and informal business operators in its vaccination list has been accepted by the Science, Technology and Innovation Ministry (Mosti). The program mechanism has also been discussed with the Federal Territories Ministry and and Housing and Local Government Ministry.

Last month, Medac announced that it is working to ensure that micro entrepreneurs and informal business operators are included as vaccine recipients as the group deals directly with the public and should be considered as frontliners.

This scheme is expected to benefit nearly 2.5 million micro and informal entrepreneurs nationwide, including 900,000 entrepreneurs who are registered with the ministry and related agencies.

In another development, Medac's recommendation to include micro entrepreneurs and informal business operators in its vaccination list has been accepted by the Science, Technology and Innovation Ministry (Mosti). The program mechanism has also been discussed with the Federal Territories Ministry and and Housing and Local Government Ministry.

Last month, Medac announced that it is working to ensure that micro entrepreneurs and informal business operators are included as vaccine recipients as the group deals directly with the public and should be considered as frontliners.

Thursday, July 1, 2021

GAP Close All 81 Stores - UK & Ireland

Gap Inc has confirmed plans to close all 81 of its stores in the UK and Ireland with the estimated loss of more than 1,000 jobs. The US retailer said the stores would close between late August and the end of September this year but it would continue to operate its online store in the UK and Ireland. Gap did not confirm the number of jobs that would go but is estimated to have employed at least 20 people in each outlet.

The decision is the result of a review of the San Francisco-based firm’s European operations that began in October last year. Gap said earlier this month that it would close just 19 stores in the UK and Ireland as they came to the end of their lease.

Gap said on Wednesday that it is also aiming to sell off its stores in Italy and France, to be run by different franchise operators, as part of the review.

The latest closures come after Gap’s parent group closed all its Banana Republic stores in the UK in 2016. The US brand has struggled to find distinctive appeal in the highly competitive UK market.

Gap is the latest fashion chain to exit the UK high street as shoppers rein in spending on clothing during the pandemic. Worldwide sales for Gap Inc, which also includes Old Navy and Athleta, sank 16% to $16.4bn last year, despite online growth.

Topshop, Debenhams, Oasis, Warehouse, Karen Millen and Laura Ashley have all disappeared from the high street in the past 18 months while even Marks & Spencer, Next, House of Fraser and John Lewis have reduced their store estate.

The shift to working from home, cancellations of events from theatre trips to weddings, combined with health fears and economic worries, put a further dampener on an industry that was already suffering from rising costs and tough competition from online specialists such as Asos and Boohoo.

Spending on technology and experiences has also diverted money away from clothing, while consumers have begun to question the fast-fashion industry and its environmental and ethical impact. The industry has warned that action is needed by the government to adjust business rates, a property tax which they say unfairly burdens high street retailers and helps online rivals.