Perlindungan Tenang is an initiative launched by BNM in 2017 in collaboration with the insurance and takaful industry to provide microinsurance/microtakaful products (being life and general insurance and takaful products) to the unserved and underserved segments, in particular the households belonging to the bottom 40% of the income groups in Malaysia (B40), which are affordable, accessible, provide good protection value and are easy to understand, simple to purchase and to make claims.

The Policy Document seeks to provide a more enabling and fit-for-purpose regulatory framework since the launch of the Perlindungan Tenang initiative in 2017 and focuses on the following areas:

- Empower licensed persons to offer more innovative, diverse and meaningful microinsurance and microtakaful products in a sustainable manner through clearer expectations on product development

- Promote a wider take-up of microinsurance and microtakaful products by broadening the distribution channels to address challenges associated with high distribution costs, as well as enabling product combination; and

- Strengthen consumer protection requirements to safeguard consumer interests.

|

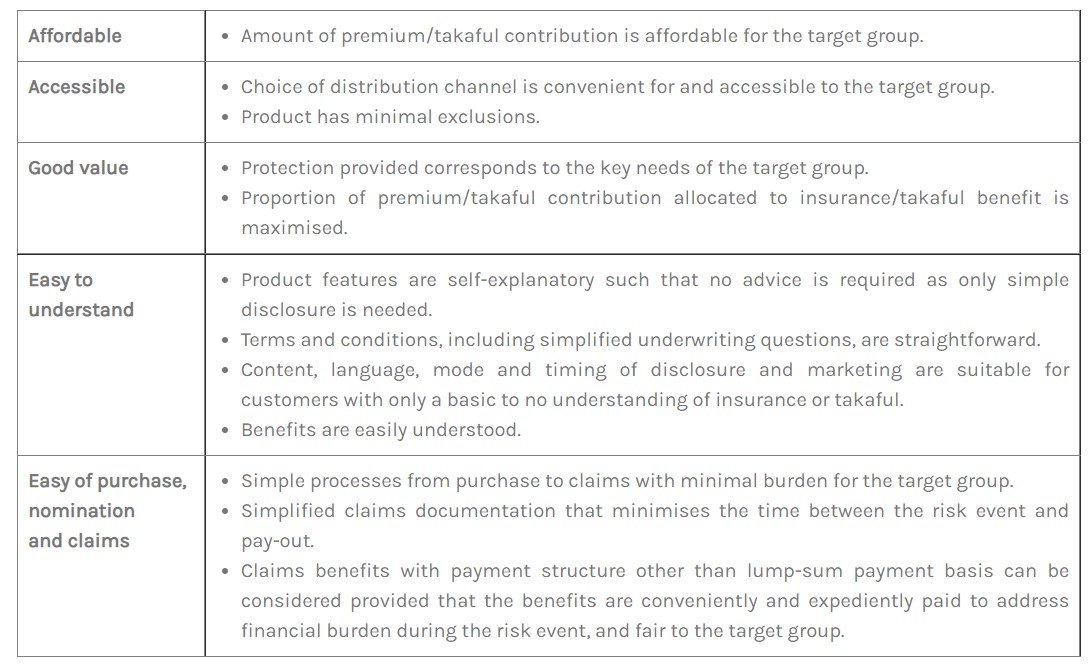

Licensed persons are required to meet the following requirements for Perlindungan Tenang products:

- minimum 15 days free look period and 30 days grace period for policies or takaful certificates with term coverage of at least one year

- allows guaranteed acceptance or on-the-spot acceptance or rejection of risk

- without savings or investment feature, or surrender benefits; and

- claims to be paid out within five working days (for death claims) and seven working days (for non-death claims) from the receipt of a claim notification.

The requirements and matters to be considered in relation to the structuring and offering of combined products are set out in section 9 of the Policy Document.

All Perlindungan Tenang products (including combined products) require BNM’s approval before they are launched.

A new category of intermediaries, ‘Perlindungan Tenang partner’ (‘PT Partner’), is introduced to broaden the distribution channels for Perlindungan Tenang products. This new category is in addition to the existing intermediaries. A PT Partner must be:

- a sole proprietorship, partnership or company;

- an agent bank; or

- a society, including co-operatives or non-governmental organisation.

There is no limit to the number of licensed persons a PT Partner may represent.

Detailed requirements relating to a PT Partner are set out in sections 10 and 11 of the Policy Document.d underserved segments of Malaysian society.

No comments:

Post a Comment