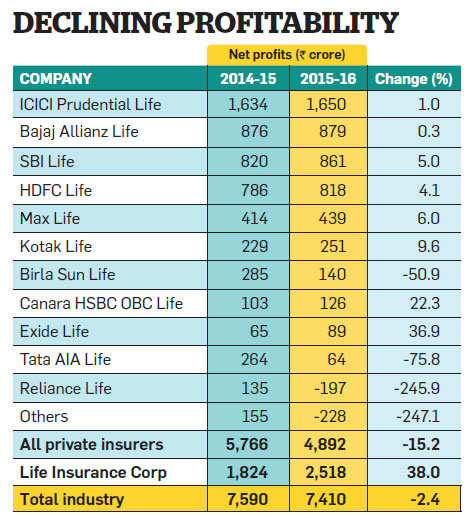

The net profit of the state-owned Life Insurance Corporation shot up 38% in 2015-16, but most private life insurers witnessed tepid growth. The combined net profits of 22 private life insurance companies declined 15%—from Rs 5,787 crore in the previous year to Rs 4,892 crore in 2015-16—pulling down the overall profit of the industry by 2.4%.

ICICI Prudential Life Insurance, the most profitable private life insurance company, registered a 1% growth in net profit while Bajaj Allianz Life Insurance saw an even smaller 0.3% uptick. Other bigger players such as SBI Life, HDFC Life and Max Life also churned out lacklustre numbers (see table).

Observers say the new Ulip rules are to be blamed for private insurers' poor performance. "Earlier, lapsation of policies was accounted as profit for the insurance company. Since a lot of Ulips were lapsing, the bottom line of life insurers showed a healthy growth in profits," says Manoj Nagpal, CEO of Outlook Asia Capital. Under the new rules, the corpus of lapsed or surrendered policies goes into a discontinuance fund that returns the money to the policyholder on completion of five years, after deducting surrender charges that are low and capped.

The change in rules has had a tectonic effect on the bottom lines of some companies. Reliance Life Insurance, which made a net profit of Rs 135 crore in 2014-15, stumbled into the red with a loss of Rs 197 crore in 2015-16. Birla Sun Life Insurance saw its profits halve from Rs 285 crore to Rs 140 crore.

On the other hand, LIC does not have a big Ulip portfolio and, therefore, was not impacted by the new rules. "LIC focuses on traditional plans, so its profit growth is more sustainable," says Nagpal.

However, even though LIC accounts for almost 65% of the new business every year, its share in the total industry profit is only 34%. "LIC's cost of distribution is very high because it depends heavily on the agency channel," says insurance professional Abhijeet Mhatre. Private companies are far more efficient. ICICI Prudential Life, which started operations in 2000 and is ready with an IPO, has more than 22% share in the industry's profits.

No comments:

Post a Comment