The Financial Services Authority, or OJK, recently said it has enlisted the Communications Ministry to block more than 400 websites and smartphone applications offering illegal P2P lending services.

Officials said they also have issued warnings to 78 registered P2P lenders, threatening to revoke their licenses if they are found in violation.

"We've also asked banks to cut illegal fintech companies' cash flow," Agus Fajri, OJK director for customer services, told a news conference on Dec. 12. "If they detect transactions by illegal fintech lenders, we told them to block the accounts. We prohibit all payment systems from serving illegal fintech."

The OJK's measures followed a report by the Jakarta Legal Aid Foundation, which says it has received more than 1,300 complaints against P2P lenders; most of the outfits were found to be illegal.

This is in addition to 2,000 complaints reportedly received by the OJK, though the foundation accused the authority of failing to act against offenders until legal aid lawyers raised the issue publicly.

The complaints, the lawyers said, include intimidation and sexual harassment during debt collections, as well as breaches of data privacy and failures to properly record loan payments, resulting in swelling interest charges.

Registered P2P companies are blaming the problem on illegal players, which OJK officials said are hard to control and often come from abroad, including China, Thailand and Malaysia.

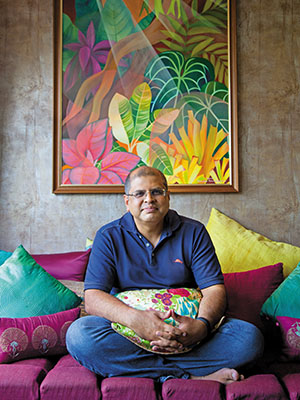

"We really regret that an industry that has the potential to advance financial inclusion in Indonesia has had its reputation tainted by irresponsible players," said Reynold Wijaya, co-founder and chief executive of Modalku, a registered P2P lender. "We think the OJK is taking the right measures by limiting the scope of illegal players, and by educating the public of how to choose P2P lenders correctly."

P2P lending -- along with fintech in general -- has grown rapidly in Indonesia over the past few years. According to the OJK, registered P2P lenders have channeled a combined 16 trillion rupiah ($1.1 billion) in loans to 2.8 million borrowers, mostly small and midsize businesses, since the regulator began collecting data in December 2016.

This figure is minuscule compared with bank loans. But the rapid rise in P2P lending shows increasing appetite for such financing in a country where 51% of the adult population, or 95 million people, lack an account at a traditional financial institution or a mobile money provider, according to 2017 data from the World Bank.

On the other hand, internet penetration last year reached 55% of the total population, or 143 million people -- half of whom access the internet through smartphones, according to Indonesia’s Internet Service Provider Association.

"The large number of unbanked and underserved people causes P2P players to keep popping up," said Hendrikus Passagi, OJK director for regulation, licensing and supervision. By underserved, he means "people who have bank accounts but need funds quickly" -- something banks are often unable to provide.

Passagi said P2P lenders are not always entirely at fault. The OJK found cases where a single customer borrowed on 30 or 40 platforms, which resulted in the borrower being chased by debt collectors. But Passagi warned P2P lenders against "unethical" debt collections, and urged victims to report such behavior to police.

Officials advise lenders to report borrowers in cases of default to the regulator, so they can be put in a blacklist and cut off from future loans.

The legal aid foundation, however, accused the OJK of blaming victims and siding with the industry, as well as failing to do more to protect the public against malpractice by P2P lenders.

"The fact is, even legal platforms have committed violations, and there have been no comprehensive sanctions against the illegal ones -- they keep operating," foundation lawyer Jeanny Silvia Sari Sirait said in a statement.